Save Form

Print Form

Reset Form

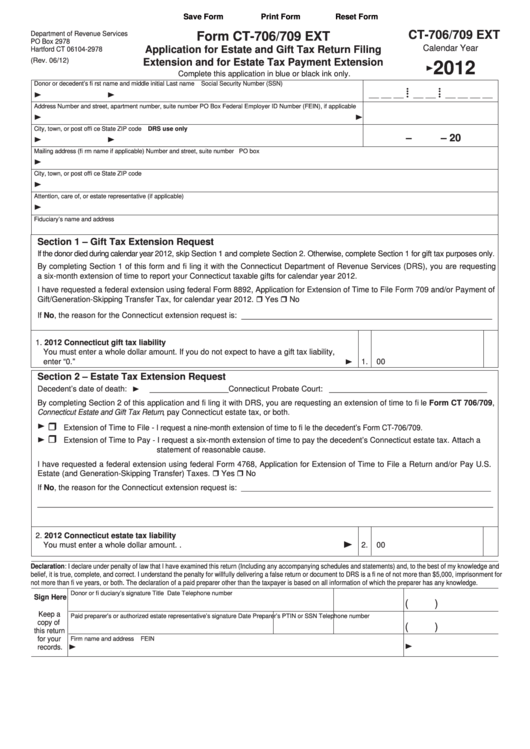

CT-706/709 EXT

Department of Revenue Services

Form CT-706/709 EXT

PO Box 2978

Calendar Year

Application for Estate and Gift Tax Return Filing

Hartford CT 06104-2978

(Rev. 06/12)

Extension and for Estate Tax Payment Extension

2012

Complete this application in blue or black ink only.

Donor or decedent’s fi rst name and middle initial

Last name

Social Security Number (SSN)

• •

• •

__ __ __

• •

• •

__ __

__ __ __ __

Address

Number and street, apartment number, suite number

PO Box

Federal Employer ID Number (FEIN), if applicable

City, town, or post offi ce

State

ZIP code

DRS use only

–

– 20

Mailing address (fi rm name if applicable)

Number and street, suite number

PO box

City, town, or post offi ce

State

ZIP code

Attention, care of, or estate representative (if applicable)

Fiduciary’s name and address

Section 1 – Gift Tax Extension Request

If the donor died during calendar year 2012, skip Section 1 and complete Section 2. Otherwise, complete Section 1 for gift tax purposes only.

By completing Section 1 of this form and fi ling it with the Connecticut Department of Revenue Services (DRS), you are requesting

a six-month extension of time to report your Connecticut taxable gifts for calendar year 2012.

I have requested a federal extension using federal Form 8892, Application for Extension of Time to File Form 709 and/or Payment of

Yes

No

Gift/Generation-Skipping Transfer Tax, for calendar year 2012.

_________________________________________________

If No, the reason for the Connecticut extension request is:

1. 2012 Connecticut gift tax liability

You must enter a whole dollar amount. If you do not expect to have a gift tax liability,

enter “0.” ...........................................................................................................................

1.

00

Section 2 – Estate Tax Extension Request

__________________ Connecticut Probate Court: ____________________________________

Decedent’s date of death:

By completing Section 2 of this application and fi ling it with DRS, you are requesting an extension of time to fi le Form CT 706/709,

Connecticut Estate and Gift Tax Return, pay Connecticut estate tax, or both.

Extension of Time to File - I request a nine-month extension of time to fi le the decedent’s Form CT-706/709.

Extension of Time to Pay - I request a six-month extension of time to pay the decedent’s Connecticut estate tax. Attach a

statement of reasonable cause.

I have requested a federal extension using federal Form 4768, Application for Extension of Time to File a Return and/or Pay U.S.

Yes

No

Estate (and Generation-Skipping Transfer) Taxes.

If No, the reason for the Connecticut extension request is: _________________________________________________________

________________________________________________________________________________________________________

2. 2012 Connecticut estate tax liability

You must enter a whole dollar amount. . ..........................................................................

2.

00

Declaration: I declare under penalty of law that I have examined this return (Including any accompanying schedules and statements) and, to the best of my knowledge and

belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to DRS is a fi ne of not more than $5,000, imprisonment for

not more than fi ve years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Donor or fi duciary’s signature

Title

Date

Telephone number

Sign Here

(

)

Keep a

Paid preparer’s or authorized estate representative’s signature

Date

Preparer’s PTIN or SSN Telephone number

copy of

(

)

this return

for your

Firm name and address

FEIN

records.

1

1 2

2