Instructions For Arizona Form 120x - Arizona Amended Corporation Income Tax Return - 2011 Page 7

ADVERTISEMENT

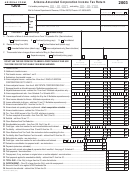

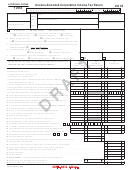

Arizona Form 120X

Certification

Interest

The department will calculate any interest due and will either

One or more of the following officers (president, treasurer, or

include it in the refund or bill the taxpayer for the interest.

any other principal officer) must sign the return.

Obtain information and current interest rates by contacting one

Paid preparers: Sign and date the return. Complete the firm

of the numbers listed on page 1 of these instructions. Interest

name and address lines (the preparer’s name and address, if

rate tables are also available on the department’s internet home

self-employed). Enter the preparer’s TIN, which is the firm’s

page at the address listed on page 1 of these instructions.

EIN or the individual preparer’s social security number or

preparer tax identification number.

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7