Print

Clear

l

*110410110002*

2011

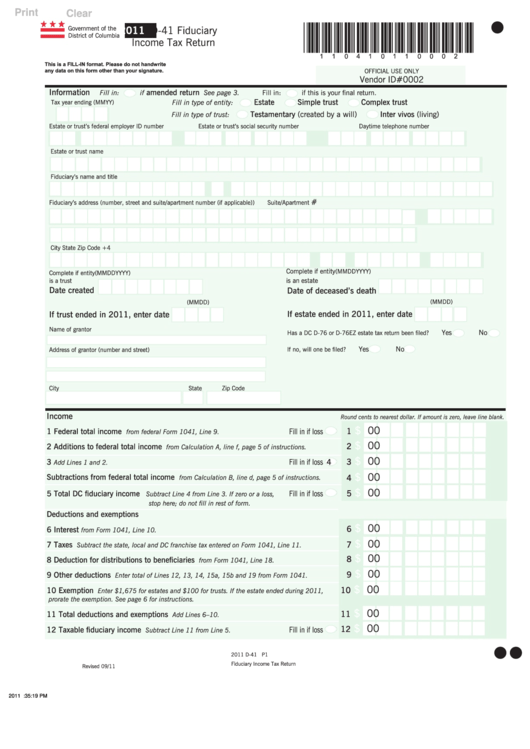

D-41 Fiduciary

Government of the

District of Columbia

Income Tax Return

This is a FILL-IN format. Please do not handwrite

any data on this form other than your signature.

OFFICIAL USE ONLY

Vendor ID#0002

Information

amended return

Fill in:

if

See page 3.

Fill in:

if this is your final return.

Estate

Simple trust

Complex trust

Tax year ending (MMYY)

Fill in type of entity:

Testamentary (created by a will)

Inter vivos (living)

Fill in type of trust:

Estate or trust’s federal employer ID number

Estate or trust’s social security number

Daytime telephone number

Estate or trust name

Fiduciary’s name and title

#

Fiduciary’s address (number, street and suite/apartment number (if applicable))

Suite/Apartment

City

State

Zip Code +4

Complete if entity

Complete if entity

(MMDDYYYY)

(MMDDYYYY)

is an estate

is a trust

Date created

Date of deceased’s death

(MMDD)

(MMDD)

If estate ended in 2011, enter date

If trust ended in 2011, enter date

Name of grantor

Yes

No

Has a DC D-76 or D-76EZ estate tax return been filed?

Yes

No

If no, will one be filed?

Address of grantor (number and street)

City

State

Zip Code

Income

Round cents to nearest dollar. If amount is zero, leave line blank.

.

$

00

1

1 Federal total income

Fill in if loss

from federal Form 1041, Line 9.

.

$

00

2

2 Additions to federal total income

from Calculation A, line f, page 5 of instructions.

.

$

00

3

Fill in if loss

3

4

Add Lines 1 and 2.

.

$

00

Subtractions from federal total income

4

from Calculation B, line d, page 5 of instructions.

.

$

00

5

5 Total DC fiduciary income

Fill in if loss

Subtract Line 4 from Line 3. If zero or a loss,

stop here; do not fill in rest of form.

Deductions and exemptions

.

$

00

6

6 Interest

from Form 1041, Line 10.

.

$

00

7 Taxes

7

Subtract the state, local and DC franchise tax entered on Form 1041, Line 11.

.

$

00

8

8 Deduction for distributions to beneficiaries

from Form 1041, Line 18.

.

$

00

9

9 Other deductions

Enter total of Lines 12, 13, 14, 15a, 15b and 19 from Form 1041.

.

$

00

10

10 Exemption

Enter $1,675 for estates and $100 for trusts. If the estate ended during 2011,

prorate the exemption. See page 6 for instructions.

.

$

00

11

11 Total deductions and exemptions

Add Lines 6–10.

.

$

00

12

12 Taxable fiduciary income

Fill in if loss

Subtract Line 11 from Line 5.

l

l

2011 D-41 P1

Fiduciary Income Tax Return

Revised 09/11

2011 D-41.indd 7

11/4/2011 3:35:19 PM

1

1 2

2