Form 140py Schedule A(Py) Itemized Deductions - 2011

ADVERTISEMENT

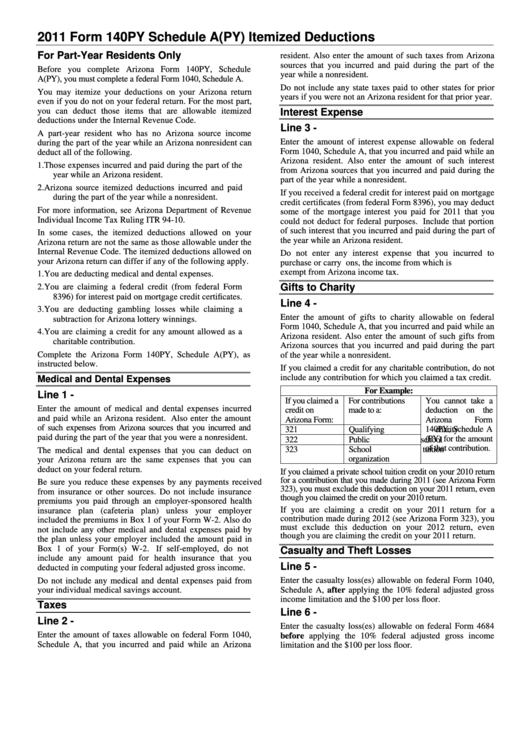

2011 Form 140PY Schedule A(PY) Itemized Deductions

For Part-Year Residents Only

resident. Also enter the amount of such taxes from Arizona

sources that you incurred and paid during the part of the

Before you complete Arizona Form 140PY, Schedule

year while a nonresident.

A(PY), you must complete a federal Form 1040, Schedule A.

Do not include any state taxes paid to other states for prior

You may itemize your deductions on your Arizona return

years if you were not an Arizona resident for that prior year.

even if you do not on your federal return. For the most part,

you can deduct those items that are allowable itemized

Interest Expense

deductions under the Internal Revenue Code.

Line 3 -

A part-year resident who has no Arizona source income

Enter the amount of interest expense allowable on federal

during the part of the year while an Arizona nonresident can

Form 1040, Schedule A, that you incurred and paid while an

deduct all of the following.

Arizona resident. Also enter the amount of such interest

1. Those expenses incurred and paid during the part of the

from Arizona sources that you incurred and paid during the

year while an Arizona resident.

part of the year while a nonresident.

2. Arizona source itemized deductions incurred and paid

If you received a federal credit for interest paid on mortgage

during the part of the year while a nonresident.

credit certificates (from federal Form 8396), you may deduct

For more information, see Arizona Department of Revenue

some of the mortgage interest you paid for 2011 that you

Individual Income Tax Ruling ITR 94-10.

could not deduct for federal purposes. Include that portion

of such interest that you incurred and paid during the part of

In some cases, the itemized deductions allowed on your

the year while an Arizona resident.

Arizona return are not the same as those allowable under the

Internal Revenue Code. The itemized deductions allowed on

Do not enter any interest expense that you incurred to

your Arizona return can differ if any of the following apply.

purchase or carry U.S. obligations, the income from which is

exempt from Arizona income tax.

1. You are deducting medical and dental expenses.

Gifts to Charity

2. You are claiming a federal credit (from federal Form

8396) for interest paid on mortgage credit certificates.

Line 4 -

3. You are deducting gambling losses while claiming a

Enter the amount of gifts to charity allowable on federal

subtraction for Arizona lottery winnings.

Form 1040, Schedule A, that you incurred and paid while an

4. You are claiming a credit for any amount allowed as a

Arizona resident. Also enter the amount of such gifts from

charitable contribution.

Arizona sources that you incurred and paid during the part

Complete the Arizona Form 140PY, Schedule A(PY), as

of the year while a nonresident.

instructed below.

If you claimed a credit for any charitable contribution, do not

include any contribution for which you claimed a tax credit.

Medical and Dental Expenses

For Example:

Line 1 -

If you claimed a

For contributions

You cannot take a

Enter the amount of medical and dental expenses incurred

credit on

made to a:

deduction on the

and paid while an Arizona resident. Also enter the amount

Arizona Form:

Arizona

Form

of such expenses from Arizona sources that you incurred and

321

Qualifying charity

140PY, Schedule A

paid during the part of the year that you were a nonresident.

(PY) for the amount

322

Public school

of that contribution.

323

School tuition

The medical and dental expenses that you can deduct on

organization

your Arizona return are the same expenses that you can

deduct on your federal return.

If you claimed a private school tuition credit on your 2010 return

for a contribution that you made during 2011 (see Arizona Form

Be sure you reduce these expenses by any payments received

323), you must exclude this deduction on your 2011 return, even

from insurance or other sources. Do not include insurance

though you claimed the credit on your 2010 return.

premiums you paid through an employer-sponsored health

If you are claiming a credit on your 2011 return for a

insurance plan (cafeteria plan) unless your employer

contribution made during 2012 (see Arizona Form 323), you

included the premiums in Box 1 of your Form W-2. Also do

must exclude this deduction on your 2012 return, even

not include any other medical and dental expenses paid by

though you are claiming the credit on your 2011 return.

the plan unless your employer included the amount paid in

Box 1 of your Form(s) W-2.

If self-employed, do not

Casualty and Theft Losses

include any amount paid for health insurance that you

Line 5 -

deducted in computing your federal adjusted gross income.

Do not include any medical and dental expenses paid from

Enter the casualty loss(es) allowable on federal Form 1040,

your individual medical savings account.

Schedule A, after applying the 10% federal adjusted gross

income limitation and the $100 per loss floor.

Taxes

Line 6 -

Line 2 -

Enter the casualty loss(es) allowable on federal Form 4684

Enter the amount of taxes allowable on federal Form 1040,

before applying the 10% federal adjusted gross income

Schedule A, that you incurred and paid while an Arizona

limitation and the $100 per loss floor.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2