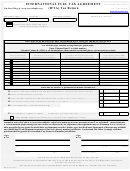

Instructions for Alternative Fuel Credit Schedule 13

This schedule(s) provides detail in support of the E85 gallons eligible for the reduced tax rate that are shown as taxable gallons on the distributor’s return (MF-52).

Non taxable E85 should NOT be included on this schedule, such as U.S. Government sales listed on Schedule 8, sales to other licensed distributors listed on Schedule 6

and Exports shown on Schedule 7.

Each load of product must be listed on separate lines of Schedule(s) 13.

Columns 1 & 2

Carrier - Enter the name and FEIN of the company that transports the products.

Column 3

Mode of Transport - Enter the mode of transport. Use one of the following: J - Truck, PL - Pipeline, B - Barge, R - Rail, O - Other.

Column 4

Point of Origin - Enter the location from which the product was transported. (IRS Terminal Code may be substituted in place of origin city and state.)

Column 5

Point of Destination - Enter the city and state of the final destination.

Column 6

Terminal Code - Use the IRS Terminal Code. (This code may be used in place of the origin city and state.)

Columns 7 & 8

Sold To/Purchaser’s FEIN - Enter the name and FEIN of the company to which the product was sold.

Column 9

Date of Manifest - Enter the date of the manifest/bill of lading.

Column 10

Manifest Number - Enter the manifest/bill of lading number.

Column 11

Gross Gallons.

Column 12

Net Gallons - quantity sold corrected to 60 degrees Fahrenheit.

Column 13

PC - Product Code

E85 - 079

Column 14

Handling Allowance Code - Use I - Licensed Importer/Exporter, C - Consumer sales, or O - Other sales that receive 2.5% handling allowance.

Line 1 - Total E85 gallons with an I or C in Column 14 (These types of sales do not take a deduction for the 2.5% handling allowance

since they do not receive the allowance on Line 6 of form MF-52).

Line 2 - Total E85 gallons with an O in Column 14 (These types of sales will deduct 2.5% handling allowance since they receive the

handling allowance on Line 6 of form MF-52)

Line 3 - Less 2.5% Handling Allowance (Line 2 multiplied by 2.5%).

Line 4 - Total gallons eligible for credit (Line 1 plus Line 2 minus Line 3).

Line 5 - Line 4 multiplied by 29.167% or .29167 (This is the total gallons deducted for the difference in tax rates on line 7 of form MF-52).

1

1 2

2