Form Mf-85 - International Fuel Tax Agreement (Ifta) Tax Return - 2007

ADVERTISEMENT

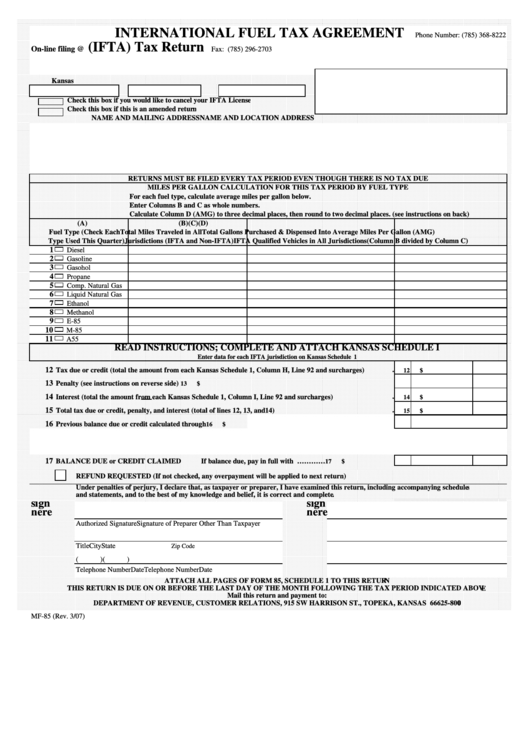

INTERNATIONAL FUEL TAX AGREEMENT

Phone Number: (785) 368-8222

(IFTA) Tax Return

On-line filing @

Fax: (785) 296-2703

Kansas I.D. Number

Tax Period

IFTA License Number

FOR OFFICE USE ONLY

Check this box if you would like to cancel your IFTA License

Check this box if this is an amended return

NAME AND MAILING ADDRESS

NAME AND LOCATION ADDRESS

RETURNS MUST BE FILED EVERY TAX PERIOD EVEN THOUGH THERE IS NO TAX DUE

MILES PER GALLON CALCULATION FOR THIS TAX PERIOD BY FUEL TYPE

For each fuel type, calculate average miles per gallon below.

Enter Columns B and C as whole numbers.

Calculate Column D (AMG) to three decimal places, then round to two decimal places. (see instructions on back)

(A)

(B)

(C)

(D)

Fuel Type (Check Each

Total Miles Traveled in All

Total Gallons Purchased & Dispensed Into

Average Miles Per Gallon (AMG)

Type Used This Quarter) Jurisdictions (IFTA and Non-IFTA)

IFTA Qualified Vehicles in All Jurisdictions

(Column B divided by Column C)

1

Diesel

2

Gasoline

3

Gasohol

4

Propane

5

Comp. Natural Gas

6

Liquid Natural Gas

7

Ethanol

8

Methanol

9

E-85

10

M-85

11

A55

READ INSTRUCTIONS; COMPLETE AND ATTACH KANSAS SCHEDULE I

Enter data for each IFTA jurisdiction on Kansas Schedule 1

12

Tax due or credit (total the amount from each Kansas Schedule 1, Column H, Line 92 and surcharges).................

12

$

13

Penalty (see instructions on reverse side)..........................................................................................................................

13

$

14

Interest (total the amount from each Kansas Schedule 1, Column I, Line 92 and surcharges)...................................

14

$

15

Total tax due or credit, penalty, and interest (total of lines 12, 13, and14)....................................................................

15

$

16

Previous balance due or credit calculated through

16

$

17

BALANCE DUE or CREDIT CLAIMED

If balance due, pay in full with return.............................…………

17

$

REFUND REQUESTED (If not checked, any overpayment will be applied to next return)

Under penalties of perjury, I declare that, as taxpayer or preparer, I have examined this return, including accompanying schedules

and statements, and to the best of my knowledge and belief, it is correct and complete.

sign

sign

here

here

Authorized Signature

Signature of Preparer Other Than Taxpayer

Title

City

State

Zip Code

(

)

(

)

Telephone Number

Date

Telephone Number

Date

ATTACH ALL PAGES OF FORM 85, SCHEDULE 1 TO THIS RETURN

THIS RETURN IS DUE ON OR BEFORE THE LAST DAY OF THE MONTH FOLLOWING THE TAX PERIOD INDICATED ABOVE

Mail this return and payment to:

DEPARTMENT OF REVENUE, CUSTOMER RELATIONS, 915 SW HARRISON ST., TOPEKA, KANSAS 66625-8000

MF-85 (Rev. 3/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2