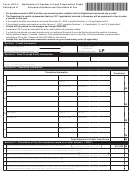

Form LPC-2

Notification of Transfer of Land Preservation Credit

*VALPC2213888*

Allocation Schedule and Calculation of Fee

Schedule A

• For donations made in 2007 and after, you cannot transfer credit(s) until the Department has issued you a credit.

• The Department is unable to guarantee that any LPC-1 application received in December will be processed in time to make

a transfer in that year.

• If the original donation was made on or before December 31, 2006, complete Sections I, II (if applicable) and III.

• If the original donation was made on or after January 1, 2007, complete Sections I , II (if applicable), III, and IV (if applicable).

• Credits will be granted to one taxpayer per line per SSN/FEIN.

• A separate LPC-2 must be completed for each credit holder who transfers credits.

• If a credit is transferred to a pass-through entity, an additional Schedule A must be filed to allocate the credit to its owners.

• Attach additional pages, if needed. However, if the allocation/transfers are to more than 15 persons/entities, we recommend

submitting a CD or disc. Please call 804-786-2992 for disc format.

• Include the Land Preservation transaction number on your check/money order (if applicable).

Section I - Credit Information

Original Credit

Current Credit Balance

$

.00

Transaction

LP

Amount of Credit to Be Distributed

$

.00

Number (Required)

Section II - Pass-Through Entity Information

For a Pass-Through Entity, Name

FEIN

Phone Number

For a pass-through entity, do you have a tax matters representative?

Representative’s Phone Number

No Yes (If Yes, Enter Name)

Section III - Transferee Information

Credit Amt.

Transferee Information

Transferred

Name (Legal Name)

Date of Credit Transfer

SSN/FEIN

Street Address

Entity Type

Fiscal Filer

1

City, State, ZIP

Sale Price of Credit

Phone Number

00

Name (Legal Name)

Date of Credit Transfer

SSN/FEIN

Street Address

Entity Type

Fiscal Filer

2

City, State, ZIP

Sale Price of Credit

Phone Number

00

Name (Legal Name)

Date of Credit Transfer

SSN/FEIN

Street Address

Entity Type

Fiscal Filer

3

City, State, ZIP

Sale Price of Credit

Phone Number

00

Name (Legal Name)

Date of Credit Transfer

SSN/FEIN

Street Address

Entity Type

Fiscal Filer

4

City, State, ZIP

Sale Price of Credit

Phone Number

00

Total Amount of Credit Transferred

00

Section IV - Calculation of Fee (For donations made on or after January 1, 2007.)

Not Applicable for Donations

(

)

1. Maximum fee that can be charged on this donation for this credit holder.

$10,000 00

Recorded On or After July 1, 2010

2. Enter the amount of fee that has been previously paid by this credit holder on this donation.

Not Applicable for Donations

(

)

3. Line 1 minus Line 2. (If the amount is zero or less, stop here. No additional fee is due.)

Recorded On or After July 1, 2010

4. Enter the total amount of credit transferred or allocated, less any gifts.

5. Multiply the total amount of credit transferred by 5% (Line 4 times .05).

6. Fee Due - For donations recorded from January 1, 2007 - June 30, 2010, enter the amount from Line 5 or Line 3, whichever

is less; for donations recorded on or after July 1, 2010, enter the amount for Line 5.

2

1

1 2

2