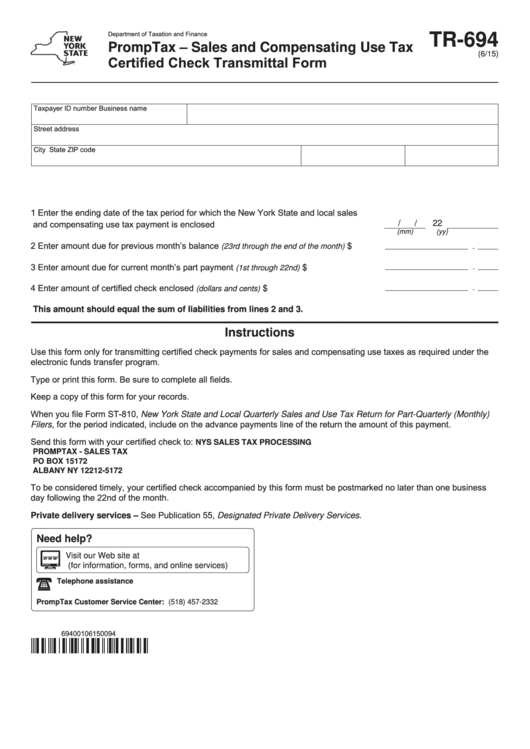

Department of Taxation and Finance

TR-694

PrompTax – Sales and Compensating Use Tax

(6/15)

Certified Check Transmittal Form

Taxpayer ID number

Business name

Street address

City

State

ZIP code

1

Enter the ending date of the tax period for which the New York State and local sales

and compensating use tax payment is enclosed .........................................................

/

22

/

(mm)

(yy)

2

Enter amount due for previous month’s balance

....... $

(23rd through the end of the month)

.

3

Enter amount due for current month’s part payment

.

.......................... $

(1st through 22nd)

4

Enter amount of certified check enclosed

.......................................... $

.

(dollars and cents)

This amount should equal the sum of liabilities from lines 2 and 3.

Instructions

Use this form only for transmitting certified check payments for sales and compensating use taxes as required under the

electronic funds transfer program.

Type or print this form. Be sure to complete all fields.

Keep a copy of this form for your records.

When you file Form ST‑810, New York State and Local Quarterly Sales and Use Tax Return for Part‑Quarterly (Monthly)

Filers, for the period indicated, include on the advance payments line of the return the amount of this payment.

Send this form with your certified check to:

NYS SALES TAX PROCESSING

PROMPTAX - SALES TAX

PO BOX 15172

ALBANY NY 12212-5172

To be considered timely, your certified check accompanied by this form must be postmarked no later than one business

day following the 22nd of the month.

Private delivery services – See Publication 55, Designated Private Delivery Services.

Need help?

Visit our Web site at

(for information, forms, and online services)

Telephone assistance

PrompTax Customer Service Center:

(518) 457-2332

69400106150094

1

1