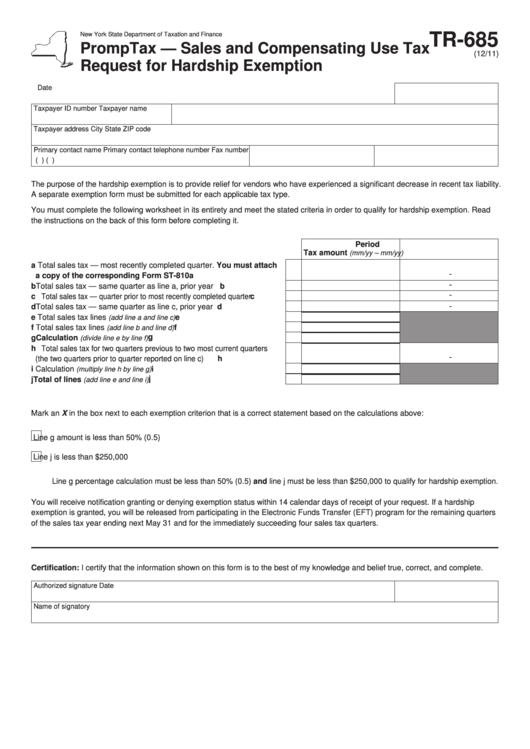

New York State Department of Taxation and Finance

TR-685

PrompTax — Sales and Compensating Use Tax

(12/11)

Request for Hardship Exemption

Date

Taxpayer ID number

Taxpayer name

Taxpayer address

City

State

ZIP code

Primary contact name

Primary contact telephone number

Fax number

(

)

(

)

The purpose of the hardship exemption is to provide relief for vendors who have experienced a significant decrease in recent tax liability.

A separate exemption form must be submitted for each applicable tax type.

You must complete the following worksheet in its entirety and meet the stated criteria in order to qualify for hardship exemption. Read

the instructions on the back of this form before completing it.

Period

Tax amount

(mm/yy – mm/yy)

a Total sales tax — most recently completed quarter. You must attach

-

a copy of the corresponding Form ST-810 ....................................

a

-

b Total sales tax — same quarter as line a, prior year .............................

b

-

c Total sales tax — quarter prior to most recently completed quarter ..............

c

-

d Total sales tax — same quarter as line c, prior year ..............................

d

e Total sales tax lines

................................................

e

(add line a and line c)

f Total sales tax lines

...............................................

f

(add line b and line d)

g

g Calculation

...........................................................

(divide line e by line f)

h Total sales tax for two quarters previous to two most current quarters

-

(the two quarters prior to quarter reported on line c) .............................

h

i

Calculation

.........................................................

i

(multiply line h by line g)

j

j

Total of lines

..........................................................

(add line e and line i)

Mark an X in the box next to each exemption criterion that is a correct statement based on the calculations above:

Line g amount is less than 50% (0.5)

Line j is less than $250,000

Line g percentage calculation must be less than 50% (0.5) and line j must be less than $250,000 to qualify for hardship exemption.

You will receive notification granting or denying exemption status within 14 calendar days of receipt of your request. If a hardship

exemption is granted, you will be released from participating in the Electronic Funds Transfer (EFT) program for the remaining quarters

of the sales tax year ending next May 31 and for the immediately succeeding four sales tax quarters.

Certification: I certify that the information shown on this form is to the best of my knowledge and belief true, correct, and complete.

Authorized signature

Date

Name of signatory

1

1 2

2