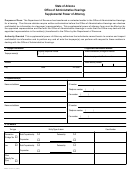

Form Et-14 - Estate Tax Power Of Attorney Page 2

ADVERTISEMENT

ET-14 (6/13) (back)

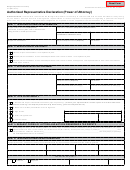

8. Declaration of representative(s) (to be completed by each representative)

I agree to represent the above-named executor in accordance with this power of attorney.

I affirm that my representation will not violate the provisions of the Ethics in Government Act restricting appearances by former Tax

Department employees. I have read a summary of these restrictions reproduced in the instructions to this form.

I am (indicate all that apply):

1 an attorney-at-law licensed to practice in New York State

2 a certified public accountant duly qualified to practice in New York State

3 a public accountant enrolled with the New York State Education Department

4 an agent enrolled to practice before the Internal Revenue Service

5 Other

Representative’s preparer tax

Designation

identification number (PTIN),

Signature

Date

(insert appropriate number

employer identification number

( EIN ), or SSN

from above list)

Instructions

General instructions

5. Notices and decisions

Purpose of form. Use Form ET-14, Estate Tax Power of Attorney, as evidence

Only one representative may receive copies of statutory notices. Notices will

automatically be sent to the first representative listed. However, if you want

that the individual(s) named as representative(s) have the authority to obligate,

copies of notices to be sent to a different representative named in section 2, or

bind, or appear on your behalf before the New York State Department of Taxation

a representative on a previously filed power of attorney, enter the name of the

and Finance’s Division of Taxation (the Department). The individual(s) named

representative you want to receive copies of notices. If you do not want copies of

as representative(s) may receive confidential information concerning your estate

tax matters. Unless you indicate otherwise, he or she may also perform any and

notices to go to any of your representatives, write none.

all acts you can perform, such as consenting to extending the time to assess

6. Executor signature

tax or executing consents agreeing to a tax adjustment. However, authorizing

Form ET-14 must be signed and dated by the executor. The Department

someone to represent you by a power of attorney does not relieve you of your tax

requires the executor, or his or her representative, to attach a copy of the Letters

obligations. A photocopy is acceptable.

Testamentary or the Letters of Administration as evidence of the executor’s

Note: Unless a change is being made, Form ET-14 should only be sent in once.

authority to execute this power of attorney.

You do not have to send in this form with every estate tax filing.

The term executor includes executrix, administrator, administratix, or personal

representative of the decedent’s estate; if no executor, executrix, administrator,

2. Representative information

administratix, or personal representative is appointed, qualified, and acting

Enter your representative’s name, mailing address (including firm name if

within the United States, executor means any person in actual or constructive

applicable), and telephone number. Also include an e-mail address and fax

number, if applicable. Only individuals may be named as representatives. You

possession of any property of the decedent.

may not appoint a firm to represent you.

8. Declaration of representative(s)

All representatives appointed will be deemed to be acting severally, unless

Your representative(s) must sign and date this declaration. The representative(s)

Form ET-14 clearly indicates that all representatives are required to act

must also insert the appropriate number designation in the box to indicate his or

jointly.

her profession or capacity to represent you before the Department.

3. Estate information

Representation for former government employees

Limitations. This power of attorney authorizes the representative(s) you

The Ethics in Government Act bars a government employee from appearing

appointed to act for you without any restrictions for the estate indicated. If you

or practicing before his or her former agency for two years after leaving public

intend to limit the authority, check the box. Attach a complete explanation (signed

service, and prohibits for life his or her participation in any matter that he or she

and dated), stating the specific restrictions.

was directly and personally involved with while a government employee.

4. Retention/revocation of prior Power(s) of Attorney

Need help?

The filing of this power of attorney automatically revokes all earlier power(s) of

attorney on file with the Tax Department for the estate covered by this form. If

Visit our Web site at

there is an existing power(s) of attorney that you do not want to revoke, check the

box on this line and attach a signed and dated copy of the power(s) of attorney

(for information, forms, and online services)

you want to remain in effect.

You may not partially revoke a previously filed power of attorney. If a previously

Estate Tax Information Center:

(518) 457-5387

filed power of attorney has more than one representative and you do not want

to retain all the representatives on that previously filed power of attorney, you

(518) 457-5431

To order forms and publications:

must indicate on the new power of attorney the representative(s) that you want

to retain.

Text Telephone (TTY) Hotline

If you want to revoke an existing power of attorney and do not want to name a

(for persons with hearing and

new representative, send a copy of the previously executed power of attorney

speech disabilities using a TTY):

(518) 485-5082

to the Department. Write revoke across the copy of the power of attorney, and

sign and date the form. If you do not have a copy of the power of attorney you

want to revoke, send a statement to the Department office where you filed the

Privacy notification —

The Commissioner of Taxation and Finance may collect and maintain personal

information pursuant to the New York State Tax Law, including but not limited to, sections 5-a, 171, 171-a,

power of attorney. The statement of revocation must indicate that the authority of

287, 308, 429, 475, 505, 697, 1096, 1142, and 1415 of that Law; and may require disclosure of social security

the power of attorney is revoked, and must be signed and dated by the taxpayer.

numbers pursuant to 42 USC 405(c)(2)(C)(i).

Also, the name and address of each recognized representative whose authority

This information will be used to determine and administer tax liabilities and, when authorized by law, for certain

is revoked must be listed.

tax offset and exchange of tax information programs as well as for any other lawful purpose.

A representative can withdraw from representation by filing a statement with the

Information concerning quarterly wages paid to employees is provided to certain state agencies for purposes

of fraud prevention, support enforcement, evaluation of the effectiveness of certain employment and training

Department. The statement must be signed and dated by the representative and

programs and other purposes authorized by law.

must identify the name and address of the executor and estate from which the

Failure to provide the required information may subject you to civil or criminal penalties, or both, under the Tax

representative is withdrawing.

Law.

This information is maintained by the Manager of Document Management, NYS Tax Department,

W A Harriman Campus, Albany NY 12227; telephone (518) 457-5181.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2