120005E8

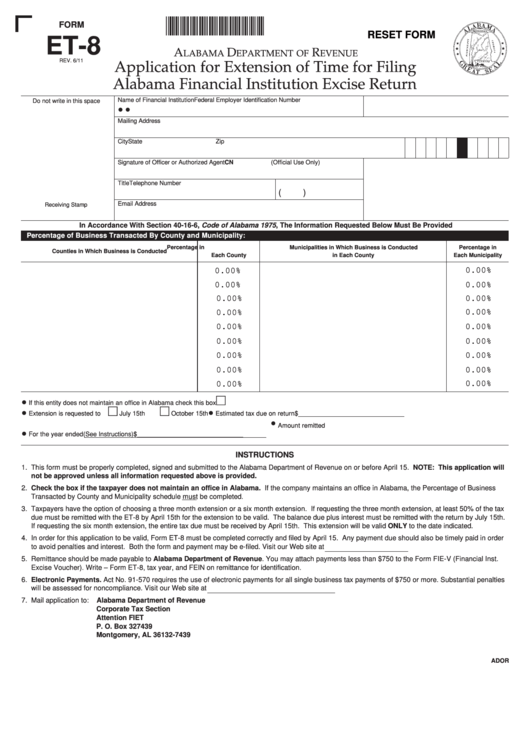

FORM

RESET FORM

ET-8

A

D

R

LABAMA

EPARTMENT OF

EVENUE

REV. 6/11

Application for Extension of Time for Filing

Alabama Financial Institution Excise Return

Name of Financial Institution

Federal Employer Identification Number

Do not write in this space

•

•

Mailing Address

City

State

Zip

Signature of Officer or Authorized Agent

CN

(Official Use Only)

Title

Telephone Number

(

)

Email Address

Receiving Stamp

In Accordance With Section 40-16-6, Code of Alabama 1975, The Information Requested Below Must Be Provided

Percentage of Business Transacted By County and Municipality:

Percentage in

Municipalities in Which Business is Conducted

Percentage in

Counties in Which Business is Conducted

Each County

in Each County

Each Municipality

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

• If this entity does not maintain an office in Alabama check this box. . . . . . . . . . . . . . .

• Extension is requested to

• Estimated tax due on return. . . . . . . . . . . . . . $______________________________

July 15th

October 15th

• Amount remitted

• For the year ended

(See Instructions) . . . . . . . . . . . . . . . . . . . . . . . . $______________________________

INSTRUCTIONS

1. This form must be properly completed, signed and submitted to the Alabama Department of Revenue on or before April 15. NOTE: This application will

not be approved unless all information requested above is provided.

2. Check the box if the taxpayer does not maintain an office in Alabama. If the company maintains an office in Alabama, the Percentage of Business

Transacted by County and Municipality schedule must be completed.

3. Taxpayers have the option of choosing a three month extension or a six month extension. If requesting the three month extension, at least 50% of the tax

due must be remitted with the ET-8 by April 15th for the extension to be valid. The balance due plus interest must be remitted with the return by July 15th.

If requesting the six month extension, the entire tax due must be received by April 15th. This extension will be valid ONLY to the date indicated.

4. In order for this application to be valid, Form ET-8 must be completed correctly and filed by April 15. Any payment due should also be timely paid in order

to avoid penalties and interest. Both the form and payment may be e-filed. Visit our Web site at and select E Services.

5. Remittance should be made payable to Alabama Department of Revenue. You may attach payments less than $750 to the Form FIE-V (Financial Inst.

Excise Voucher). Write – Form ET-8, tax year, and FEIN on remittance for identification.

6. Electronic Payments. Act No. 91-570 requires the use of electronic payments for all single business tax payments of $750 or more. Substantial penalties

will be assessed for noncompliance. Visit our Web site at /eservices.htm to e-file and e-pay this form.

7. Mail application to:

Alabama Department of Revenue

Corporate Tax Section

Attention FIET

P. O. Box 327439

Montgomery, AL 36132-7439

ADOR

1

1