160005E8

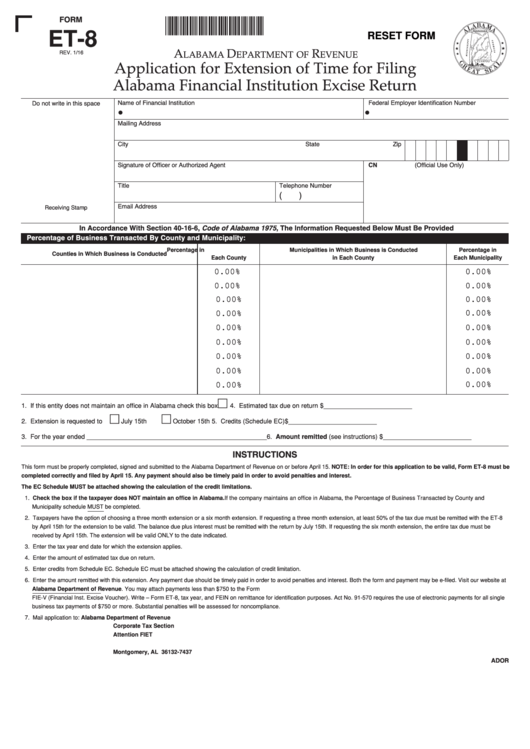

FORM

ET-8

RESET FORM

REV. 1/16

A

D

r

lAbAmA

epArtment of

evenue

Application for extension of time for filing

Alabama financial Institution excise return

Name of Financial Institution

Federal Employer Identification Number

Do not write in this space

•

•

Mailing Address

City

State

Zip

Signature of Officer or Authorized Agent

(Official Use Only)

CN

Title

Telephone Number

( )

Email Address

Receiving Stamp

In Accordance With Section 40-16-6, Code of Alabama 1975, The Information Requested Below Must Be Provided

Percentage of Business Transacted By County and Municipality:

Percentage in

Municipalities in Which Business is Conducted

Percentage in

Counties in Which Business is Conducted

Each County

in Each County

Each Municipality

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

1. If this entity does not maintain an office in Alabama check this box . . . . . . . . . . . . . .

4. Estimated tax due on return . . . . . . . . . . . . . . $_________________________

2. Extension is requested to

July 15th

October 15th

5. Credits (Schedule EC) . . . . . . . . . . . . . . . . . . . $_________________________

3. For the year ended ___________________________________________________

6. Amount remitted (see instructions) . . . . . . $_________________________

INSTRUCTIONS

This form must be properly completed, signed and submitted to the Alabama Department of Revenue on or before April 15. NOTE: In order for this application to be valid, Form ET-8 must be

completed correctly and filed by April 15. Any payment should also be timely paid in order to avoid penalties and interest.

The EC Schedule MUST be attached showing the calculation of the credit limitations.

1. Check the box if the taxpayer does NOT maintain an office in Alabama. If the company maintains an office in Alabama, the Percentage of Business Transacted by County and

Municipality schedule MUST be completed.

2. Taxpayers have the option of choosing a three month extension or a six month extension. If requesting a three month extension, at least 50% of the tax due must be remitted with the ET-8

by April 15th for the extension to be valid. The balance due plus interest must be remitted with the return by July 15th. If requesting the six month extension, the entire tax due must be

received by April 15th. The extension will be valid ONLY to the date indicated.

3. Enter the tax year end date for which the extension applies.

4. Enter the amount of estimated tax due on return.

5. Enter credits from Schedule EC. Schedule EC must be attached showing the calculation of credit limitation.

6. Enter the amount remitted with this extension. Any payment due should be timely paid in order to avoid penalties and interest. Both the form and payment may be e-filed. Visit our website at

and select My Alabama Taxes. Remittance should be made payable to Alabama Department of Revenue. You may attach payments less than $750 to the Form

FIE-V (Financial Inst. Excise Voucher). Write – Form ET-8, tax year, and FEIN on remittance for identification purposes. Act No. 91-570 requires the use of electronic payments for all single

business tax payments of $750 or more. Substantial penalties will be assessed for noncompliance.

7. Mail application to:

Alabama Department of Revenue

Corporate Tax Section

Attention FIET

P.O. Box 327437

Montgomery, AL 36132-7437

ADOR

1

1