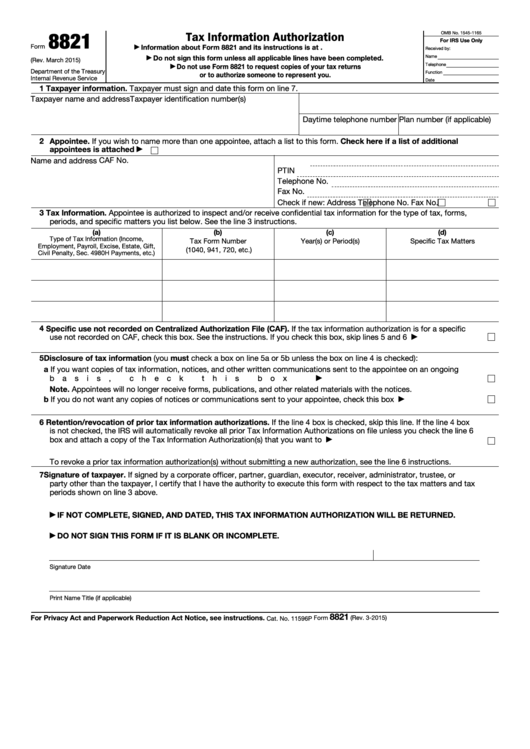

8821

Tax Information Authorization

OMB No. 1545-1165

For IRS Use Only

Form

Information about Form 8821 and its instructions is at

▶

Received by:

Do not sign this form unless all applicable lines have been completed.

Name

▶

(Rev. March 2015)

Telephone

Do not use Form 8821 to request copies of your tax returns

▶

Department of the Treasury

Function

or to authorize someone to represent you.

Internal Revenue Service

Date

1 Taxpayer information. Taxpayer must sign and date this form on line 7.

Taxpayer name and address

Taxpayer identification number(s)

Daytime telephone number Plan number (if applicable)

2 Appointee. If you wish to name more than one appointee, attach a list to this form. Check here if a list of additional

appointees is attached

▶

CAF No.

Name and address

PTIN

Telephone No.

Fax No.

Check if new: Address

Telephone No.

Fax No.

3 Tax Information. Appointee is authorized to inspect and/or receive confidential tax information for the type of tax, forms,

periods, and specific matters you list below. See the line 3 instructions.

(a)

(b)

(c)

(d)

Type of Tax Information (Income,

Tax Form Number

Year(s) or Period(s)

Specific Tax Matters

Employment, Payroll, Excise, Estate, Gift,

(1040, 941, 720, etc.)

Civil Penalty, Sec. 4980H Payments, etc.)

4 Specific use not recorded on Centralized Authorization File (CAF). If the tax information authorization is for a specific

use not recorded on CAF, check this box. See the instructions. If you check this box, skip lines 5 and 6 .

.

.

.

.

.

▶

5 Disclosure of tax information (you must check a box on line 5a or 5b unless the box on line 4 is checked):

a If you want copies of tax information, notices, and other written communications sent to the appointee on an ongoing

basis, check this box

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

Note. Appointees will no longer receive forms, publications, and other related materials with the notices.

b If you do not want any copies of notices or communications sent to your appointee, check this box

.

.

.

.

.

.

.

▶

6 Retention/revocation of prior tax information authorizations. If the line 4 box is checked, skip this line. If the line 4 box

is not checked, the IRS will automatically revoke all prior Tax Information Authorizations on file unless you check the line 6

box and attach a copy of the Tax Information Authorization(s) that you want to retain.

.

.

.

.

.

.

.

.

.

.

.

.

▶

To revoke a prior tax information authorization(s) without submitting a new authorization, see the line 6 instructions.

7 Signature of taxpayer. If signed by a corporate officer, partner, guardian, executor, receiver, administrator, trustee, or

party other than the taxpayer, I certify that I have the authority to execute this form with respect to the tax matters and tax

periods shown on line 3 above.

IF NOT COMPLETE, SIGNED, AND DATED, THIS TAX INFORMATION AUTHORIZATION WILL BE RETURNED.

▶

DO NOT SIGN THIS FORM IF IT IS BLANK OR INCOMPLETE.

▶

Signature

Date

Print Name

Title (if applicable)

8821

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 3-2015)

Cat. No. 11596P

1

1