Form 8821 - Tax Information Authorization

ADVERTISEMENT

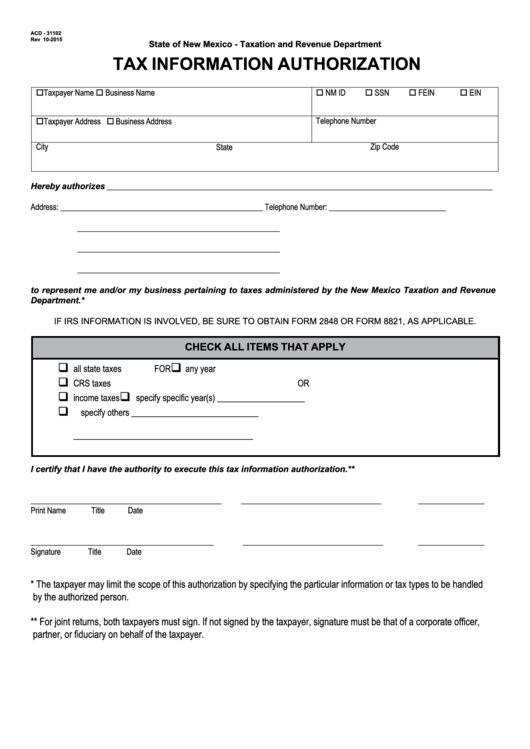

ACD - 31102

Rev 10-2015

State of New Mexico - Taxation and Revenue Department

TAX INFORMATION AUTHORIZATION

oTaxpayer Name

o Business Name

o NM ID

o SSN

o FEIN

o EIN

Telephone Number

oTaxpayer Address o Business Address

City

State

Zip Code

Hereby authorizes ___________________________________________________________________________________________________

Address:

____________________________________________________

Telephone Number: ______________________________

____________________________________________________

____________________________________________________

____________________________________________________

to represent me and/or my business pertaining to taxes administered by the New Mexico Taxation and Revenue

Department.*

IF IRS INFORMATION IS INVOLVED, BE SURE TO OBTAIN FORM 2848 OR FORM 8821, AS APPLICABLE.

CHECK ALL ITEMS THAT APPLY

q

q

all state taxes

FOR

any year

q

CRS taxes

OR

q

q

income taxes

specify specific year(s) ____________________

q

specify others _____________________________

_________________________________________

I certify that I have the authority to execute this tax information authorization.**

_________________________________________________

____________________________________

_________________

Print Name

Title

Date

_______________________________________________

____________________________________

_________________

Signature

Title

Date

*

The taxpayer may limit the scope of this authorization by specifying the particular information or tax types to be handled

by the authorized person.

** For joint returns, both taxpayers must sign. If not signed by the taxpayer, signature must be that of a corporate officer,

partner, or fiduciary on behalf of the taxpayer.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1