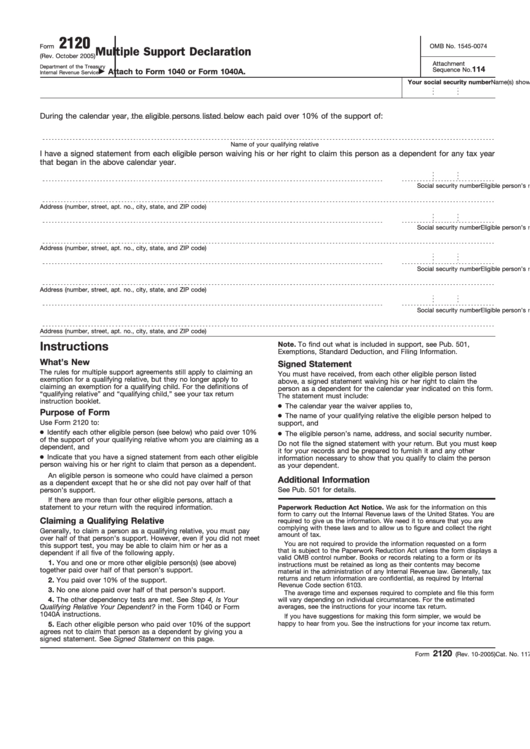

2120

OMB No. 1545-0074

Form

Multiple Support Declaration

(Rev. October 2005)

Attachment

Department of the Treasury

114

Sequence No.

Attach to Form 1040 or Form 1040A.

Internal Revenue Service

Name(s) shown on return

Your social security number

During the calendar year

, the eligible persons listed below each paid over 10% of the support of:

Name of your qualifying relative

I have a signed statement from each eligible person waiving his or her right to claim this person as a dependent for any tax year

that began in the above calendar year.

Eligible person’s name

Social security number

Address (number, street, apt. no., city, state, and ZIP code)

Eligible person’s name

Social security number

Address (number, street, apt. no., city, state, and ZIP code)

Eligible person’s name

Social security number

Address (number, street, apt. no., city, state, and ZIP code)

Eligible person’s name

Social security number

Address (number, street, apt. no., city, state, and ZIP code)

Instructions

Note. To find out what is included in support, see Pub. 501,

Exemptions, Standard Deduction, and Filing Information.

What’s New

Signed Statement

The rules for multiple support agreements still apply to claiming an

You must have received, from each other eligible person listed

exemption for a qualifying relative, but they no longer apply to

above, a signed statement waiving his or her right to claim the

claiming an exemption for a qualifying child. For the definitions of

person as a dependent for the calendar year indicated on this form.

“qualifying relative” and “qualifying child,” see your tax return

The statement must include:

instruction booklet.

● The calendar year the waiver applies to,

Purpose of Form

● The name of your qualifying relative the eligible person helped to

Use Form 2120 to:

support, and

● Identify each other eligible person (see below) who paid over 10%

● The eligible person’s name, address, and social security number.

of the support of your qualifying relative whom you are claiming as a

Do not file the signed statement with your return. But you must keep

dependent, and

it for your records and be prepared to furnish it and any other

● Indicate that you have a signed statement from each other eligible

information necessary to show that you qualify to claim the person

person waiving his or her right to claim that person as a dependent.

as your dependent.

An eligible person is someone who could have claimed a person

Additional Information

as a dependent except that he or she did not pay over half of that

See Pub. 501 for details.

person’s support.

If there are more than four other eligible persons, attach a

statement to your return with the required information.

Paperwork Reduction Act Notice. We ask for the information on this

form to carry out the Internal Revenue laws of the United States. You are

Claiming a Qualifying Relative

required to give us the information. We need it to ensure that you are

complying with these laws and to allow us to figure and collect the right

Generally, to claim a person as a qualifying relative, you must pay

amount of tax.

over half of that person’s support. However, even if you did not meet

You are not required to provide the information requested on a form

this support test, you may be able to claim him or her as a

that is subject to the Paperwork Reduction Act unless the form displays a

dependent if all five of the following apply.

valid OMB control number. Books or records relating to a form or its

1. You and one or more other eligible person(s) (see above)

instructions must be retained as long as their contents may become

together paid over half of that person’s support.

material in the administration of any Internal Revenue law. Generally, tax

returns and return information are confidential, as required by Internal

2. You paid over 10% of the support.

Revenue Code section 6103.

3. No one alone paid over half of that person’s support.

The average time and expenses required to complete and file this form

4. The other dependency tests are met. See Step 4, Is Your

will vary depending on individual circumstances. For the estimated

Qualifying Relative Your Dependent? in the Form 1040 or Form

averages, see the instructions for your income tax return.

1040A instructions.

If you have suggestions for making this form simpler, we would be

happy to hear from you. See the instructions for your income tax return.

5. Each other eligible person who paid over 10% of the support

agrees not to claim that person as a dependent by giving you a

signed statement. See Signed Statement on this page.

2120

Cat. No. 11712F

Form

(Rev. 10-2005)

1

1