Form C-3 - Domicile Declaration

ADVERTISEMENT

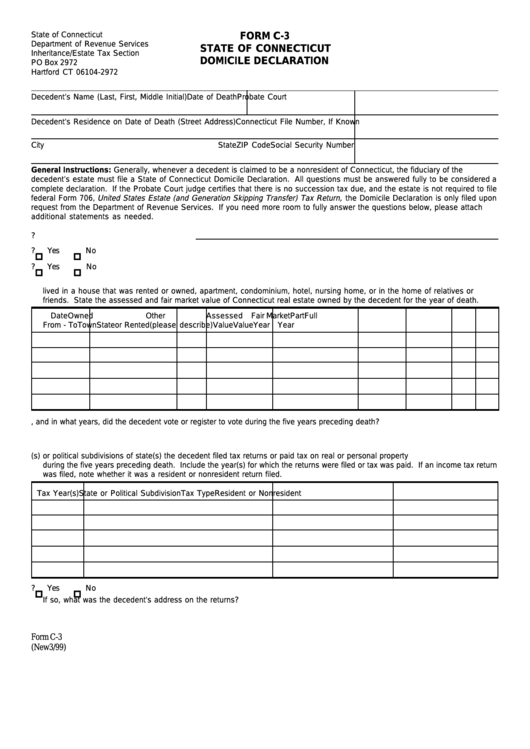

State of Connecticut

FORM C-3

Department of Revenue Services

STATE OF CONNECTICUT

Inheritance/Estate Tax Section

DOMICILE DECLARATION

PO Box 2972

Hartford CT 06104-2972

Decedent’s Name (Last, First, Middle Initial)

Date of Death

Probate Court

Decedent’s Residence on Date of Death (Street Address)

Connecticut File Number, If Known

City

State

ZIP Code

Social Security Number

General Instructions: Generally, whenever a decedent is claimed to be a nonresident of Connecticut, the fiduciary of the

decedent’s estate must file a State of Connecticut Domicile Declaration. All questions must be answered fully to be considered a

complete declaration. If the Probate Court judge certifies that there is no succession tax due, and the estate is not required to file

federal Form 706, United States Estate (and Generation Skipping Transfer) Tax Return, the Domicile Declaration is only filed upon

request from the Department of Revenue Services. If you need more room to fully answer the questions below, please attach

additional statements as needed.

1. What is your relationship to the decedent?

2. Did the decedent ever live in Connecticut?

Yes

No

3. Did the decedent live part of the year in Connecticut and part of the year outside of Connecticut?

Yes

No

4. Identify and describe each place of residence of the decedent for the five years preceding death. Indicate whether the decedent

lived in a house that was rented or owned, apartment, condominium, hotel, nursing home, or in the home of relatives or

friends. State the assessed and fair market value of Connecticut real estate owned by the decedent for the year of death.

Date

Owned

Other

Assessed

Fair Market Part

Full

From - To

Town

State

or Rented

(please describe)

Value

Value

Year Year

5. Where, and in what years, did the decedent vote or register to vote during the five years preceding death?

6. Identify in which state(s) or political subdivisions of state(s) the decedent filed tax returns or paid tax on real or personal property

during the five years preceding death. Include the year(s) for which the returns were filed or tax was paid. If an income tax return

was filed, note whether it was a resident or nonresident return filed.

Tax Year(s)

State or Political Subdivision

Tax Type

Resident or Nonresident

7. Did the decedent file federal income tax returns?

Yes

No

If so, what was the decedent’s address on the returns?

Form C-3

(New3/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2