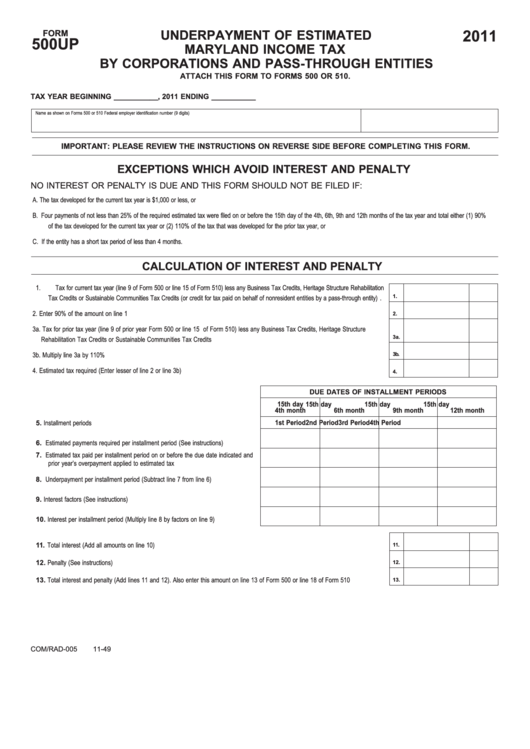

2011

UNDERPAYMENT OF ESTIMATED

FORM

500UP

MARYLAND INCOME TAX

BY CORPORATIONS AND PASS-THROUGH ENTITIES

ATTACH THIS FORM TO FORMS 500 OR 510.

TAX YEAR BEGINNING ___________, 2011 ENDING ___________

Name as shown on Forms 500 or 510

Federal employer identification number (9 digits)

IMPORTANT: PLEASE REVIEW THE INSTRUCTIONS ON REVERSE SIDE BEFORE COMPLETING THIS FORM.

EXCEPTIONS WHICH AVOID INTEREST AND PENALTY

NO INTEREST OR PENALTY IS DUE AND THIS FORM SHOULD NOT BE FILED IF:

A. The tax developed for the current tax year is $1,000 or less, or

B. Four payments of not less than 25% of the required estimated tax were filed on or before the 15th day of the 4th, 6th, 9th and 12th months of the tax year and total either (1) 90%

of the tax developed for the current tax year or (2) 110% of the tax that was developed for the prior tax year, or

C. If the entity has a short tax period of less than 4 months.

CALCULATION OF INTEREST AND PENALTY

1.

Tax for current tax year (line 9 of Form 500 or line 15 of Form 510) less any Business Tax Credits, Heritage Structure Rehabilitation

1.

Tax Credits or Sustainable Communities Tax Credits (or credit for tax paid on behalf of nonresident entities by a pass-through entity) .

2.

Enter 90% of the amount on line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3a. Tax for prior tax year (line 9 of prior year Form 500 or line 15 of Form 510) less any Business Tax Credits, Heritage Structure

3a.

Rehabilitation Tax Credits or Sustainable Communities Tax Credits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3b. Multiply line 3a by 110% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3b.

4.

Estimated tax required (Enter lesser of line 2 or line 3b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

DUE DATES OF INSTALLMENT PERIODS

15th day

15th day

15th day

15th day

4th month

6th month

9th month

12th month

5. Installment periods . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1st Period

2nd Period

3rd Period

4th Period

6. Estimated payments required per installment period (See instructions) . . . . . . . . . .

7. Estimated tax paid per installment period on or before the due date indicated and

prior year’s overpayment applied to estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Underpayment per installment period (Subtract line 7 from line 6) . . . . . . . . . . . . . .

9. Interest factors (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. Interest per installment period (Multiply line 8 by factors on line 9) . . . . . . . . . . . . .

11. Total interest (Add all amounts on line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

12. Penalty (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12.

13. Total interest and penalty (Add lines 11 and 12). Also enter this amount on line 13 of Form 500 or line 18 of Form 510 . . . . . . . . .

13.

COM/RAD-005

11-49

1

1 2

2