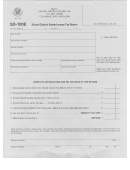

SD 100E

Rev. 10/12

Page 2

General Instructions for Filing Ohio Form SD 100E

What Estates Are Required To File Ohio Form SD 100E?

Note: If the 15th day of the fourth month following the close of the

If at the time of death the decedent was a resident of a school district

taxable year is a weekend or holiday, then the return and payment

with a “traditional” income tax base and if the estate is required to

are due on the next business day.

fi le an Ohio Fiduciary Income Tax Return, Ohio form IT 1041, then

What Period Is To Be Refl ected on Ohio Form SD 100E?

the fi duciary of the estate must fi le a School District Estate Income

Use the same period of time as shown on IRS form 1041 and on

Tax Return, Ohio form SD 100E, for the estate’s taxable year.

Ohio form IT 1041.

What School Districts Impose School District Tax on

Is This Your Final Return?

Estates?

If this is your fi nal return, please check the box on page 1 of this return.

Estates in “traditional” income tax base districts must fi le and pay

school district income tax on their income. Estates in “earned

What if I Need to Correct My Estate Return After I File?

income only” tax base districts do not have to fi le and pay school

You may make any change or correction to your already fi led return

district income tax on their income. Click on the appropriate link to

by fi ling another Estate Income Tax Return, Ohio form SD 100E,

view school districts with an income tax and applicable tax rates.

with corrected fi gures and checking the “Amended Return” box. To

speed up the processing of your amended return:

2007 school district tax rates

2010 school district tax rates

•

Attach a copy of your original return, AND

2008 school district tax rates

2011 school district tax rates

•

Attach a copy of any cancelled checks used as payment on the

2009 school district tax rates

2012 school district tax rates

originally fi led return.

When Is Ohio Form SD 100E Due?

You can obtain Ohio form SD 100E from our Web site at

The fi duciary should fi le Ohio form SD 100E and pay any tax due

tax.ohio.gov.

th

on or before the 15

day of the fourth month following the close of

If the fi duciary amends the Federal Fiduciary Income Tax Return or if

the estate’s taxable year. However, if the estate has an extension of

the fi duciary is audited by the IRS, the fi duciary must fi le an amended

time to fi le federal form 1041, the estate has the same extension of

time to fi le the school district income tax return, Ohio form SD 100E.

Ohio form SD 100E within 60 days of the fi nal determination of the

federal change.

Note: An extension of time to fi le is not an extension of time to

pay. By the 15

th

day of the fourth month following the close of the

Caution: The IRS tells us when it makes changes to tax returns. To

estate’s taxable year, the estate must pay all school district income

avoid penalties, be sure to fi le the amended SD 100E return within

60 days of the fi nal determination of the federal change.

tax due. To make an extension payment, the estate should send in

the payment along with a school district estate income tax payment

What If I Have Other Questions About This Return?

voucher (Ohio form SD 40EP) for the appropriate taxable year,

Contact us via our Web site at tax.ohio.gov or call us at

which is available on page 3.

1-800-282-1780.

Line Instructions for Filing Ohio Form SD 100E

Procedure for Preparer’s Name

Line 2 School district tax rates. Click on the appropriate link below

to view the year-specifi c tax rates that apply.

The Ohio Department of Taxation follows IRS Notice 2004-54, which

provides for alternative preparer signature procedures for federal

2007 school district tax rates

2010 school district tax rates

income tax paper returns that paid practitioners prepare on behalf

2008 school district tax rates

2011 school district tax rates

of their clients. Paid preparers can follow those same procedures

with respect to the following Ohio paper returns: individual income

2009 school district tax rates

2012 school district tax rates

tax, school district income tax, withholding tax (employer and pass-

through entity) and corporation franchise tax. See Ohio Revised

Line 4 If you fi le your return after the unextended due date and you

Code sections 5703.262(B) and 5747.08(F).

paid and/or will pay any tax after the unextended due date,

you owe interest unless the refund, if any, shown on line 8

Exception: The paid preparer should print (rather than write) his/her

is greater than any tax you paid after the unextended due

name on the form if the taxpayer checks “Yes” to the question, “Do

date. Interest is due on late-paid tax even if the IRS has

you authorize your preparer to contact us regarding this return?”

granted you a fi ling extension. For a listing of each year’s

interest rate, visit our Web site at tax.ohio.gov and click

Federal Privacy Act Notice

on “Tax Professionals” and then click on “Interest Rates.”

Interest is due on all tax that you paid and/or will pay after

Because we require you to provide us with the decedent’s social se-

the unextended due date.

curity account number, the Federal Privacy Act of 1974 requires us to

inform you that your providing us the decedent’s Social Security num-

Ohio law requires that the estate pay an interest penalty if the

ber is mandatory. Ohio Revised Code sections 5703.05, 5703.057

tax due, net of (i) withholding and (ii) timely paid estimates,

and 5747.08 authorize us to request this information. We need the

is $500 or more. However, some exceptions may apply. Use

decedent’s Social Security number in order to administer this tax.

Ohio form IT/SD 2210 to compute the interest penalty and

to see if any of the exceptions apply.

- 2 -

1

1 2

2 3

3