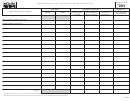

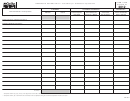

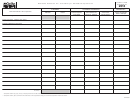

FORM 1120N

Nebraska Schedule IV — Converting Net Income to Combined Net Income

Schedule IV

2013

• If this schedule is used, read instructions and attach this schedule to Form 1120N.

Name on Form 1120N

Nebraska ID Number

24 —

Corporation Names (Enter names as column headings.)

Eliminations

Combined Income

Income and Deductions

(Attach explanation.)

1 Gross receipts or sales less returns

and allowances ...................................................

2 Cost of goods sold ..............................................

3 Gross profit (Subtract line 2 from line 1) .............

4 Dividends ............................................................

5 Interest ................................................................

6 Gross rents .........................................................

7 Gross royalties ....................................................

8 Capital gain net income ......................................

9 Net gain (loss) .....................................................

10 Other income ......................................................

11 TOTAL INCOME

(total of lines 3 through 10) .................................

12 Compensation of officers ....................................

13 Salaries and wages (less employment credit) ....

14 Repairs and maintenance ...................................

15 Bad debts ............................................................

16 Rents ..................................................................

17 Taxes ..................................................................

18 Interest ................................................................

19 Charitable contributions ......................................

20 Depreciation not claimed elsewhere on

federal return .....................................................

21 Depletion .............................................................

22 Advertising ..........................................................

23 Pension, profit sharing, etc., plans ......................

24 Employee benefit plans .......................................

25 Domestic production activities deduction ............

26 Other deductions (attach schedules) ..................

27 TOTAL DEDUCTIONS (total of lines 12

through 26) .........................................................

28 Taxable income before federal adjustments

(line 11 minus line 27) .........................................

29 Less: a Net operating loss deduction ...............

b Special deductions ..............................

30 Taxable income (line 28 minus lines 29a and 29b).

Enter amount in “Combined Income” column and

on line 2, Form 1120N .........................................

1

1 2

2