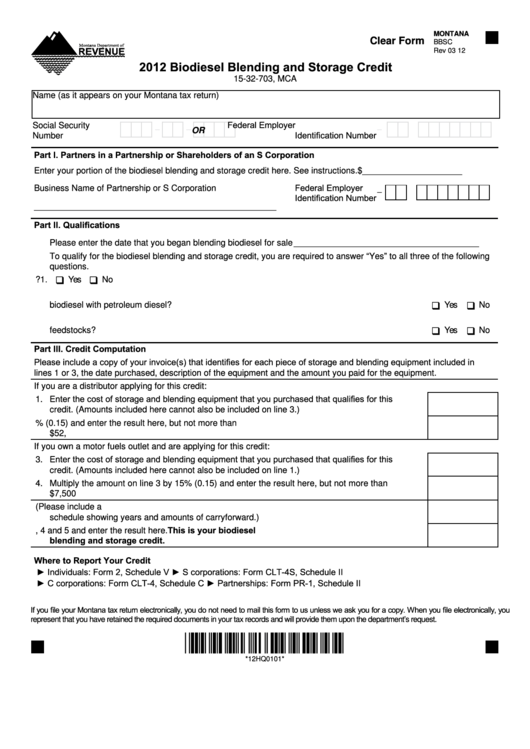

MONTANA

Clear Form

BBSC

Rev 03 12

2012 Biodiesel Blending and Storage Credit

15-32-703, MCA

Name (as it appears on your Montana tax return)

Federal Employer

Social Security

-

-

-

X X X X X X X X X

X X X X X X X X X

OR

Identification Number

Number

Part I. Partners in a Partnership or Shareholders of an S Corporation

Enter your portion of the biodiesel blending and storage credit here. See instructions.

$_____________________

Federal Employer

Business Name of Partnership or S Corporation

-

Identification Number

___________________________________________________

Part II. Qualifications

Please enter the date that you began blending biodiesel for sale _______________________________________

To qualify for the biodiesel blending and storage credit, you are required to answer “Yes” to all three of the following

questions.

q

q

1. Did you blend biodiesel with petroleum diesel for sale during this year? ....................................... 1.

Yes

No

2. Is the storage and blending equipment you purchased used in Montana primarily to blend

q

q

biodiesel with petroleum diesel?..................................................................................................... 2.

Yes

No

3. Is the biodiesel you blend with petroleum diesel made entirely from Montana-produced

q

q

feedstocks? .................................................................................................................................... 3.

Yes

No

Part III. Credit Computation

Please include a copy of your invoice(s) that identifies for each piece of storage and blending equipment included in

lines 1 or 3, the date purchased, description of the equipment and the amount you paid for the equipment.

If you are a distributor applying for this credit:

1. Enter the cost of storage and blending equipment that you purchased that qualifies for this

credit. (Amounts included here cannot also be included on line 3.) ............................................... 1.

2. Multiply the amount on line 1 by 15% (0.15) and enter the result here, but not more than

$52,500........................................................................................................................................... 2.

If you own a motor fuels outlet and are applying for this credit:

3. Enter the cost of storage and blending equipment that you purchased that qualifies for this

credit. (Amounts included here cannot also be included on line 1.) ............................................... 3.

4. Multiply the amount on line 3 by 15% (0.15) and enter the result here, but not more than

$7,500 ............................................................................................................................................ 4.

5. Enter the amount of tax credit being carried forward from previous years. (Please include a

schedule showing years and amounts of carryforward.) ................................................................ 5.

6. Add the amounts on lines 2, 4 and 5 and enter the result here. This is your biodiesel

blending and storage credit. ....................................................................................................... 6.

Where to Report Your Credit

► Individuals: Form 2, Schedule V

► S corporations: Form CLT-4S, Schedule II

► C corporations: Form CLT-4, Schedule C

► Partnerships: Form PR-1, Schedule II

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically, you

represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

*12HQ0101*

*12HQ0101*

1

1 2

2