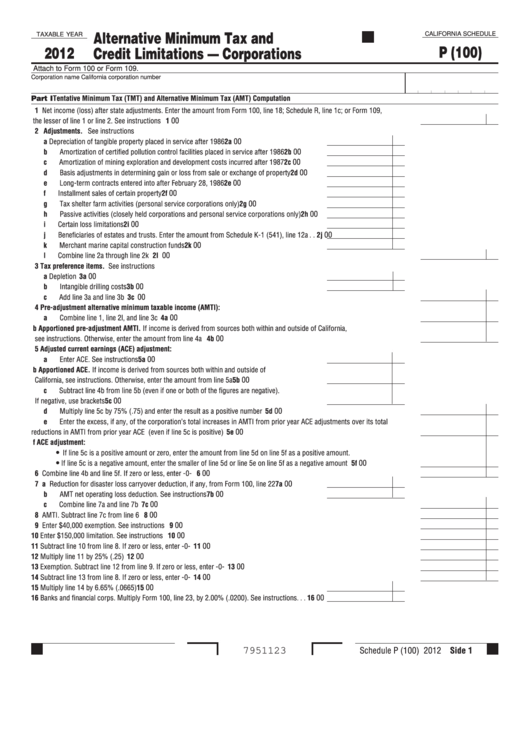

Alternative Minimum Tax and

CALIFORNIA SCHEDULE

TAXABLE YEAR

P (100)

2012

Credit Limitations — Corporations

Attach to Form 100 or Form 109.

Corporation name

California corporation number

Part I

Tentative Minimum Tax (TMT) and Alternative Minimum Tax (AMT) Computation

1 Net income (loss) after state adjustments. Enter the amount from Form 100, line 18; Schedule R, line 1c; or Form 109,

00

the lesser of line 1 or line 2. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Adjustments. See instructions

00

a Depreciation of tangible property placed in service after 1986 . . . . . . . . . . . . . . . . . . . . . . . 2a

00

b Amortization of certified pollution control facilities placed in service after 1986 . . . . . . . . . 2b

00

c Amortization of mining exploration and development costs incurred after 1987 . . . . . . . . . 2c

00

d Basis adjustments in determining gain or loss from sale or exchange of property. . . . . . . . 2d

e Long-term contracts entered into after February 28, 1986 . . . . . . . . . . . . . . . . . . . . . . . . . . 2e

00

00

f Installment sales of certain property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2f

00

g Tax shelter farm activities (personal service corporations only) . . . . . . . . . . . . . . . . . . . . . . 2g

00

h Passive activities (closely held corporations and personal service corporations only). . . . . 2h

00

i Certain loss limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2i

00

j Beneficiaries of estates and trusts. Enter the amount from Schedule K-1 (541), line 12a . . 2j

00

k Merchant marine capital construction funds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2k

00

l Combine line 2a through line 2k . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2l

3 Tax preference items. See instructions

00

a Depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3a

b Intangible drilling costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3b

00

00

c Add line 3a and line 3b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3c

4 Pre-adjustment alternative minimum taxable income (AMTI):

a Combine line 1, line 2l, and line 3c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4a

00

b Apportioned pre-adjustment AMTI. If income is derived from sources both within and outside of California,

00

see instructions. Otherwise, enter the amount from line 4a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4b

5 Adjusted current earnings (ACE) adjustment:

00

a Enter ACE. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5a

b Apportioned ACE. If income is derived from sources both within and outside of

00

California, see instructions. Otherwise, enter the amount from line 5a. . . . . . . . . . . . . . . . . 5b

c Subtract line 4b from line 5b (even if one or both of the figures are negative).

00

If negative, use brackets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5c

00

d Multiply line 5c by 75% (.75) and enter the result as a positive number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5d

e Enter the excess, if any, of the corporation’s total increases in AMTI from prior year ACE adjustments over its total

00

reductions in AMTI from prior year ACE adjustments. Enter an amount on line 5e (even if line 5c is positive) . . . . . . . . . . . . 5e

f ACE adjustment:

•

If line 5c is a positive amount or zero, enter the amount from line 5d on line 5f as a positive amount.

•

00

If line 5c is a negative amount, enter the smaller of line 5d or line 5e on line 5f as a negative amount . . . . . . . . . . . . . . . . 5f

00

6 Combine line 4b and line 5f. If zero or less, enter -0-. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

00

7 a Reduction for disaster loss carryover deduction, if any, from Form 100, line 22 . . . . . . . . . 7a

b AMT net operating loss deduction. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7b

00

00

c Combine line 7a and line 7b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7c

00

8 AMTI. Subtract line 7c from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Enter $40,000 exemption. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

00

00

10 Enter $150,000 limitation. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

00

11 Subtract line 10 from line 8. If zero or less, enter -0-. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

00

12 Multiply line 11 by 25% (.25). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

00

13 Exemption. Subtract line 12 from line 9. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

00

14 Subtract line 13 from line 8. If zero or less, enter -0-. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

00

15 Multiply line 14 by 6.65% (.0665) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

00

16 Banks and financial corps. Multiply Form 100, line 23, by 2.00% (.0200). See instructions

16

. . .

Schedule P (100) 2012 Side 1

7951123

1

1 2

2