Instructions For Form N-152 - Tax On Lump-Sum Distributions - 2012

ADVERTISEMENT

Clear Form

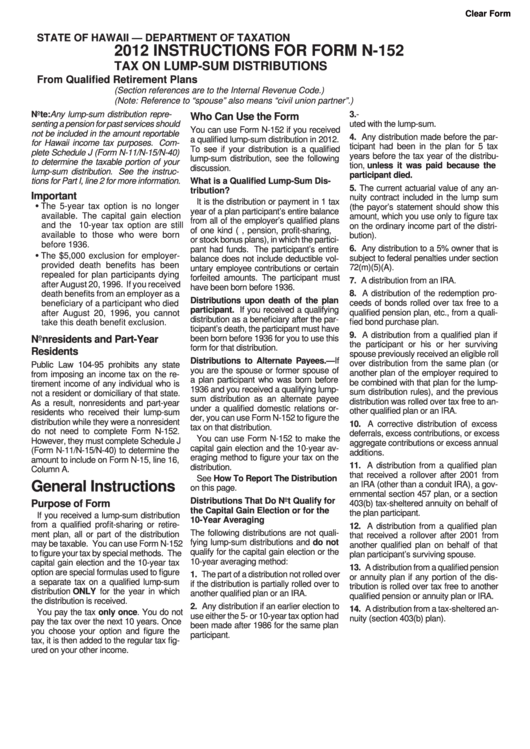

STATE OF HAWAII — DEPARTMENT OF TAXATION

2012 INSTRUCTIONS FOR FORM N-152

TAX ON LUMP-SUM DISTRIBUTIONS

From Qualified Retirement Plans

(Section references are to the Internal Revenue Code.)

(Note: Reference to “spouse” also means “civil union partner”.)

Note: Any lump-sum distribution repre-

3. U.S. Retirement Plan Bonds distrib-

Who Can Use the Form

senting a pension for past services should

uted with the lump-sum.

You can use Form N-152 if you received

not be included in the amount reportable

4. Any distribution made before the par-

a qualified lump-sum distribution in 2012.

for Hawaii income tax purposes. Com-

ticipant had been in the plan for 5 tax

To see if your distribution is a qualified

plete Schedule J (Form N-11/N-15/N-40)

years before the tax year of the distribu-

lump-sum distribution, see the following

to determine the taxable portion of your

tion, unless it was paid because the

discussion.

lump-sum distribution. See the instruc-

participant died.

tions for Part I, line 2 for more information.

What is a Qualified Lump-Sum Dis-

5. The current actuarial value of any an-

tribution?

Important

nuity contract included in the lump sum

It is the distribution or payment in 1 tax

• The 5-year tax option is no longer

(the payor’s statement should show this

year of a plan participant’s entire balance

available. The capital gain election

amount, which you use only to figure tax

from all of the employer’s qualified plans

and the 10-year tax option are still

on the ordinary income part of the distri-

of one kind (i.e., pension, profit-sharing,

available to those who were born

bution).

or stock bonus plans), in which the partici-

before 1936.

6. Any distribution to a 5% owner that is

pant had funds. The participant’s entire

• The $5,000 exclusion for employer-

subject to federal penalties under section

balance does not include deductible vol-

provided death benefits has been

72(m)(5)(A).

untary employee contributions or certain

repealed for plan participants dying

forfeited amounts. The participant must

7. A distribution from an IRA.

after August 20, 1996. If you received

have been born before 1936.

8. A distribution of the redemption pro-

death benefits from an employer as a

Distributions upon death of the plan

beneficiary of a participant who died

ceeds of bonds rolled over tax free to a

participant. If you received a qualifying

qualified pension plan, etc., from a quali-

after August 20, 1996, you cannot

distribution as a beneficiary after the par-

fied bond purchase plan.

take this death benefit exclusion.

ticipant’s death, the participant must have

9. A distribution from a qualified plan if

been born before 1936 for you to use this

Nonresidents and Part-Year

the participant or his or her surviving

form for that distribution.

Residents

spouse previously received an eligible roll

Distributions to Alternate Payees.—If

over distribution from the same plan (or

Public Law 104-95 prohibits any state

you are the spouse or former spouse of

another plan of the employer required to

from imposing an income tax on the re-

a plan participant who was born before

be combined with that plan for the lump-

tirement income of any individual who is

1936 and you received a qualifying lump-

sum distribution rules), and the previous

not a resident or domiciliary of that state.

sum distribution as an alternate payee

distribution was rolled over tax free to an-

As a result, nonresidents and part-year

under a qualified domestic relations or-

other qualified plan or an IRA.

residents who received their lump-sum

der, you can use Form N-152 to figure the

distribution while they were a nonresident

10. A corrective distribution of excess

tax on that distribution.

do not need to complete Form N-152.

deferrals, excess contributions, or excess

You can use Form N-152 to make the

However, they must complete Schedule J

aggregate contributions or excess annual

capital gain election and the 10-year av-

(Form N-11/N-15/N-40) to determine the

additions.

eraging method to figure your tax on the

amount to include on Form N-15, line 16,

11. A distribution from a qualified plan

distribution.

Column A.

that received a rollover after 2001 from

See How To Report The Distribution

General Instructions

an IRA (other than a conduit IRA), a gov-

on this page.

ernmental section 457 plan, or a section

Distributions That Do Not Qualify for

Purpose of Form

403(b) tax-sheltered annuity on behalf of

the Capital Gain Election or for the

the plan participant.

If you received a lump-sum distribution

10-Year Averaging

from a qualified profit-sharing or retire-

12. A distribution from a qualified plan

The following distributions are not quali-

ment plan, all or part of the distribution

that received a rollover after 2001 from

fying lump-sum distributions and do not

may be taxable. You can use Form N-152

another qualified plan on behalf of that

qualify for the capital gain election or the

to figure your tax by special methods. The

plan participant’s surviving spouse.

10-year averaging method:

capital gain election and the 10-year tax

13. A distribution from a qualified pension

option are special formulas used to figure

1. The part of a distribution not rolled over

or annuity plan if any portion of the dis-

a separate tax on a qualified lump-sum

if the distribution is partially rolled over to

tribution is rolled over tax free to another

distribution ONLY for the year in which

another qualified plan or an IRA.

qualified pension or annuity plan or IRA.

the distribution is received.

2. Any distribution if an earlier election to

14. A distribution from a tax-sheltered an-

You pay the tax only once. You do not

use either the 5- or 10-year tax option had

nuity (section 403(b) plan).

pay the tax over the next 10 years. Once

been made after 1986 for the same plan

you choose your option and figure the

participant.

tax, it is then added to the regular tax fig-

ured on your other income.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4