Clear Form

Form

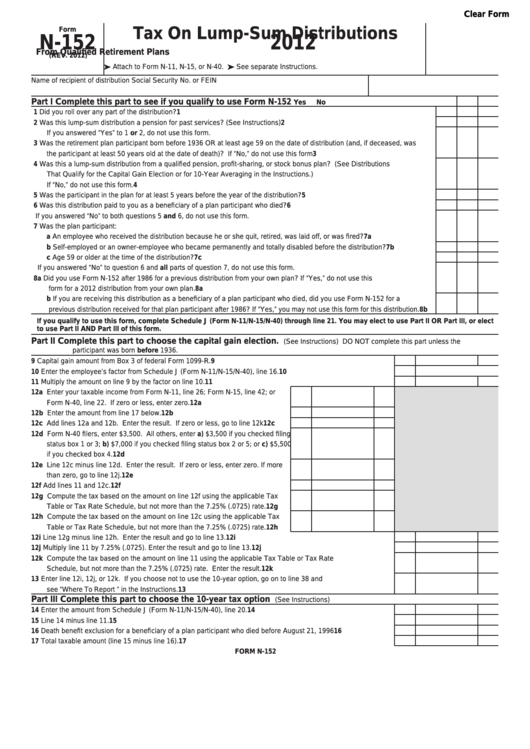

Tax On Lump-Sum Distributions

N-152

2012

From Qualified Retirement Plans

(REV. 2012)

Attach to Form N-11, N-15, or N-40. See separate Instructions.

Name of recipient of distribution

Social Security No. or FEIN

Part I

Complete this part to see if you qualify to use Form N-152

Yes

No

1

Did you roll over any part of the distribution? ................................................................................................................................

1

2

Was this lump-sum distribution a pension for past services? (See Instructions) ...........................................................................

2

If you answered “Yes” to 1 or 2, do not use this form.

3

Was the retirement plan participant born before 1936 OR at least age 59 on the date of distribution (and, if deceased, was

the participant at least 50 years old at the date of death)? If “No,” do not use this form ...............................................................

3

4

Was this a lump-sum distribution from a qualified pension, profit-sharing, or stock bonus plan? (See Distributions

That Qualify for the Capital Gain Election or for 10-Year Averaging in the Instructions.)

If “No,” do not use this form. ...........................................................................................................................................................

4

5

Was the participant in the plan for at least 5 years before the year of the distribution? ................................................................

5

6

Was this distribution paid to you as a beneficiary of a plan participant who died? ........................................................................

6

If you answered “No” to both questions 5 and 6, do not use this form.

7

Was the plan participant:

a An employee who received the distribution because he or she quit, retired, was laid off, or was fired? ..................................

7a

b Self-employed or an owner-employee who became permanently and totally disabled before the distribution? ......................

7b

c Age 59 or older at the time of the distribution? ........................................................................................................................

7c

If you answered “No” to question 6 and all parts of question 7, do not use this form.

8

a Did you use Form N-152 after 1986 for a previous distribution from your own plan? If “Yes,” do not use this

form for a 2012 distribution from your own plan. ......................................................................................................................

8a

b If you are receiving this distribution as a beneficiary of a plan participant who died, did you use Form N-152 for a

previous distribution received for that plan participant after 1986? If “Yes,” you may not use this form for this distribution. .....

8b

If you qualify to use this form, complete Schedule J (Form N-11/N-15/N-40) through line 21. You may elect to use Part II OR Part III, or elect

to use Part II AND Part III of this form.

Part II

Complete this part to choose the capital gain election.

(See Instructions) DO NOT complete this part unless the

participant was born before 1936.

9

Capital gain amount from Box 3 of federal Form 1099-R. ........................................................................................

9

10

Enter the employee’s factor from Schedule J (Form N-11/N-15/N-40), line 16. ........................................................

10

11

Multiply the amount on line 9 by the factor on line 10. ..............................................................................................

11

12a Enter your taxable income from Form N-11, line 26; Form N-15, line 42; or

Form N-40, line 22. If zero or less, enter zero. ...................................................

12a

12b Enter the amount from line 17 below. .................................................................

12b

12c Add lines 12a and 12b. Enter the result. If zero or less, go to line 12k .............

12c

12d Form N-40 filers, enter $3,500. All others, enter a) $3,500 if you checked filing

status box 1 or 3; b) $7,000 if you checked filing status box 2 or 5; or c) $5,500

if you checked box 4. ..........................................................................................

12d

12e Line 12c minus line 12d. Enter the result. If zero or less, enter zero. If more

than zero, go to line 12j. .....................................................................................

12e

12f Add lines 11 and 12c. .........................................................................................

12f

12g Compute the tax based on the amount on line 12f using the applicable Tax

Table or Tax Rate Schedule, but not more than the 7.25% (.0725) rate. ............

12g

12h Compute the tax based on the amount on line 12c using the applicable Tax

Table or Tax Rate Schedule, but not more than the 7.25% (.0725) rate. ............

12h

12i Line 12g minus line 12h. Enter the result and go to line 13. ....................................................................................

12i

12j Multiply line 11 by 7.25% (.0725). Enter the result and go to line 13. .......................................................................

12j

12k Compute the tax based on the amount on line 11 using the applicable Tax Table or Tax Rate

Schedule, but not more than the 7.25% (.0725) rate. Enter the result. ....................................................................

12k

13

Enter line 12i, 12j, or 12k. If you choose not to use the 10-year option, go on to line 38 and

see “Where To Report ” in the Instructions. ..............................................................................................................

13

Part III

Complete this part to choose the 10-year tax option

(See Instructions)

14

Enter the amount from Schedule J (Form N-11/N-15/N-40), line 20. .......................................................................

14

15

Line 14 minus line 11. ...............................................................................................................................................

15

16

Death benefit exclusion for a beneficiary of a plan participant who died before August 21, 1996 ...........................

16

17

Total taxable amount (line 15 minus line 16). ...........................................................................................................

17

FORM N-152

1

1 2

2