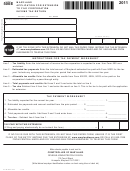

MARYLAND

INSTRUCTIONS

Page 2

FOR FORM 500E

APPLICATION FOR EXTENSION

2011

TO FILE CORPORATION

INCOME TAX RETURN

Purpose of Form Maryland law provides for an extension

How to file Complete the Tax Payment Worksheet on

of time to file the corporation income tax return (Form

page 1.

500), but not to pay the tax due. Use Form 500E to remit

If line 5 is zero, file in one of the following ways:

any tax that may be due. Also use Form 500E if this is

1) Telefile – Request an automatic extension by

the first filing of the corporation even if no tax is due.

calling 410-260-7829 from Central Maryland or

Note: Do not use this form to extend the time for filing a

1-800-260-3664 from elsewhere to telefile this

Form 510 or to remit employer withholding tax.

form. Please have the form available when making

General Requirements Extensions are allowable for up

the call.

to seven months from the original due date. An automatic

Note: Telefile service is available 24 hours a day, 7

seven month extension will be granted if Form 500E is

days a week. Calling during non-peak hours will

filed by the original due date.

make it easier to file.

• If no tax is due - File the extension online, telefile or

2) Internet – File the ex tension at w w w.

use Form 500E if this is the first filing of the corporation.

, and look for Online Services/

• If tax is due - Make full payment by electronic funds

Services for Business. If filed by Internet, do not

transfer or by using Form 500E if paying by check or

mail 500E; retain it with the company’s records.

money order.

3) Filing electronically using Modernized Electronic

Consolidated returns are not allowed under Maryland law.

Filing method (software provider must be approved

Affiliated corporations that file a consolidated federal

by the IRS and Revenue Administration Division). If

return must file a separate Maryland extension for each

filed electronically, do not mail 500E; retain it

member corporation.

with company’s records.

Do not mail the Form 500E if, after completing the

4) First filing of corporation – Mail Form 500E.

Tax Payment Worksheet, no additional tax is due.

If line 5 shows an amount due, file in one of the following

Instead, you may telefile or file on our Web site unless

ways:

this is the first filing of the corporation. However, if an

1) Electronic Funds Transfer – Taxpayers must

unpaid liability is disclosed when the return is filed,

register before using this method. To obtain a

penalty and interest charges may be due in addition to

registration form, visit

the tax.

or call 410-260-7980. If payment is made by

When to file File Form 500E by the 15th day of the third

electronic funds transfer, do not mail, retain for

month following the close of the tax year or period, or by

company’s records.

the original due date required for filing the federal income

2) Filing electronically using Modernized Electronic

tax return.

Filing method (software provider must be approved

Name, Address and Other Information Type or print

by the IRS and Revenue Administration Division). If

the required information in the designated area.

filed electronically, do not mail 500E; retain it with

Enter the federal employer identification number (FEIN).

company’s records.

If a FEIN has not been secured, enter “APPLIED FOR”

Taxpayers making payments of $10,000 or more must

followed by the date of application. If a FEIN has not been

use one of these two electronic methods.

applied for, do so immediately.

3) Payment by check or money order – Complete

Enter the name exactly as specified in the Articles of

Form 500E and mail to:

Incorporation, or as amended, and continue with any

Comptroller of Maryland

“Trading As” (T/A) name, if applicable.

Revenue Administration Division

Tax Year or Period Enter the beginning and ending dates

110 Carroll Street

of the tax year in the space provided if the tax year is

Annapolis, MD 21411-0001

other than a calendar year.

Payment Instructions Include a check or money order

The same tax year or period used for the federal return

made payable to Comptroller of Maryland. All payments

must be used for Form 500E.

must indicate the FEIN, type of tax and tax year beginning

and ending dates. DO NOT SEND CASH.

COM/RAD-003

11-49

1

1 2

2