Form Dtf-281 - Survivor'S Affidavit Request For Refunds Under Section 1310 Scpa Page 2

ADVERTISEMENT

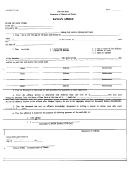

DTF-281 (4/11) (back)

Part II

If box (B), (C), (D), or (E) is checked, or if box (A) is checked and this affidavit is being made pursuant to SCPA section 1310(3), I attest that:

(1) I am the

of the decedent.

(specify relationship to decedent)

(2) Probate of the decedent’s estate has not begun. No fiduciary of the estate of said decedent has qualified or been appointed.

(3) No designation of a beneficiary is in effect.

(4) 30 or more days have elapsed after the death of the decedent.

(5) At the time of his/her death, there was due and owing to said decedent from the New York State Department of Taxation

and Finance,

the sum of

($

) dollars

for

.

(6) I make this affidavit to obtain payment in the amount of

($

) dollars

in full (or partial) satisfaction of the aforementioned debt, which will be paid to the following named persons who are entitled to and

who will receive payment as follows

:

(attach additional sheets if necessary)

(name)

(address including ZIP code)

(amount)

(name)

(address including ZIP code)

(amount)

(name)

(address including ZIP code)

(amount)

(name)

(address including ZIP code)

(amount)

(7) The payment herein requested and all other payments made under the provisions of SCPA 1310 by all debtors known to me after

diligent inquiry made by me do not in the aggregate exceed the sum of fifteen thousand ($15,000) dollars.

Signature

Printed name

Subscribed and sworn to

Mail this signed and notarized affidavit along with a

before me this

copy of the decedent’s death certificate to:

day of

, 20

NYS TAX DEPARTMENT

RDOC-REFUND ISSUING UNIT

W A HARRIMAN CAMPUS

ALBANY NY 12227

Notary Public - Commissioner of Deeds

2812110094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2