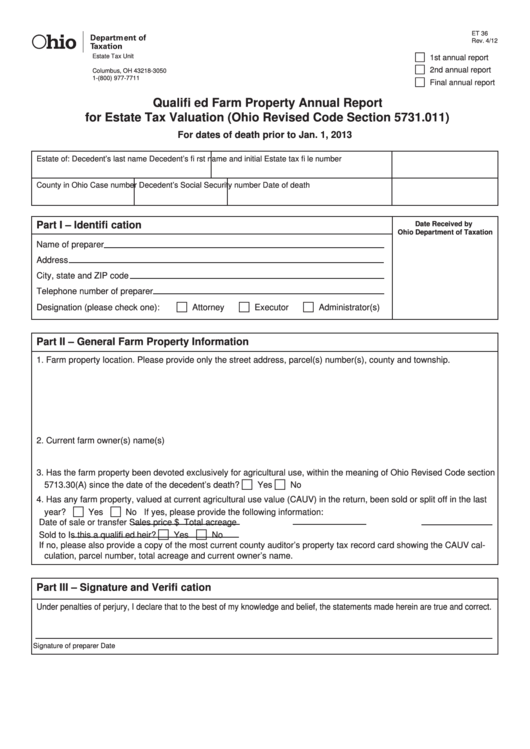

ET 36

Rev. 4/12

Reset Form

Estate Tax Unit

1st annual report

P.O. Box 183050

2nd annual report

Columbus, OH 43218-3050

1-(800) 977-7711

Final annual report

tax.ohio.gov

Qualifi ed Farm Property Annual Report

for Estate Tax Valuation (Ohio Revised Code Section 5731.011)

For dates of death prior to Jan. 1, 2013

Estate of: Decedent’s last name

Decedent’s fi rst name and initial

Estate tax fi le number

County in Ohio

Case number

Decedent’s Social Security number

Date of death

Part I – Identifi cation

Date Received by

Ohio Department of Taxation

Name of preparer

Address

City, state and ZIP code

Telephone number of preparer

Designation (please check one):

Attorney

Executor

Administrator(s)

Part II – General Farm Property Information

1. Farm property location. Please provide only the street address, parcel(s) number(s), county and township.

2. Current farm owner(s) name(s)

3. Has the farm property been devoted exclusively for agricultural use, within the meaning of Ohio Revised Code section

5713.30(A) since the date of the decedent’s death?

Yes

No

4. Has any farm property, valued at current agricultural use value (CAUV) in the return, been sold or split off in the last

year?

Yes

No If yes, please provide the following information:

Date of sale or transfer

Sales price $

Total acreage

Sold to

Is this a qualifi ed heir?

Yes

No

If no, please also provide a copy of the most current county auditor’s property tax record card showing the CAUV cal-

culation, parcel number, total acreage and current owner’s name.

Part III – Signature and Verifi cation

Under penalties of perjury, I declare that to the best of my knowledge and belief, the statements made herein are true and correct.

Signature of preparer

Date

1

1 2

2