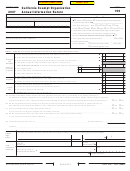

Part II Organizations with gross receipts of more than $25,000 and private foundations regardless of amount of gross receipts —

complete Part II or furnish substitute information. See Specific Line Instructions.

00

1 Gross sales or receipts from all business activities. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

2 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

Receipts

00

4 Gross rents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

from

00

5 Gross royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Other

Sources

6 Gross amount received from sale of assets (See Instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

00

7 Other income. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Total gross sales or receipts from other sources. Add line 1 through line 7.

00

Enter here and on Side 1, Part I, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

9 Contributions, gifts, grants, and similar amounts paid. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

10 Disbursements to or for members . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

00

11 Compensation of officers, directors, and trustees. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

00

12 Other salaries and wages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

Expenses

and

00

13 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

Disburse-

00

14 Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

ments

15 Rents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

00

00

16 Depreciation and depletion (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

00

17 Other Expenses and Disbursements. Attach schedule. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

00

18 Total expenses and disbursements. Add line 9 through line 17. Enter here and on Side 1, Part I, line 9 . . . . . . . . . 18

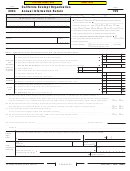

Schedule L

Balance Sheets

Beginning of taxable year

End of taxable year

Assets

(a)

(b)

(c)

(d)

1 Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Net accounts receivable . . . . . . . . . . . . . . . . . . . . . .

3 Net notes receivable. . . . . . . . . . . . . . . . . . . . . . . . . .

4 Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Federal and state government obligations . . . . . . . . .

6 Investments in other bonds. . . . . . . . . . . . . . . . . . . .

7 Investments in stock. . . . . . . . . . . . . . . . . . . . . . . . .

8 Mortgage loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 Other investments. Attach schedule . . . . . . . . . . . . .

10 a Depreciable assets . . . . . . . . . . . . . . . . . . . . . . . . .

(

)

(

)

b Less accumulated depreciation . . . . . . . . . . . . . . .

11 Land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 Other assets. Attach schedule . . . . . . . . . . . . . . . . . .

13 Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Liabilities and net worth

14 Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . .

15 Contributions, gifts, or grants payable . . . . . . . . . . .

16 Bonds and notes payable. . . . . . . . . . . . . . . . . . . . . .

17 Mortgages payable . . . . . . . . . . . . . . . . . . . . . . . . . .

18 Other liabilities. Attach schedule . . . . . . . . . . . . . . . .

19 Capital stock or principle fund . . . . . . . . . . . . . . . . . .

20 Paid-in or capital surplus. Attach reconciliation . . . .

21 Retained earnings or income fund . . . . . . . . . . . . . .

22 Total liabilities and net worth . . . . . . . . . . . . . . . . . . .

Schedule M-1 Reconciliation of income per books with income per return

Do not complete this schedule if the amount on Schedule L, line 13, column (d), is less than $25,000

1

Net income per books . . . . . . . . . . . . . . . . . . . . . . .

7 Income recorded on books this year

2

Federal income tax . . . . . . . . . . . . . . . . . . . . . . . . . .

not included in this return.

3

Excess of capital losses over capital gains . . . . . . . .

Attach schedule . . . . . . . . . . . . . . . . . . . . . .

4

Income not recorded on books this

8 Deductions in this return not charged

year. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . .

against book income this year.

5

Expenses recorded on books this year not

Attach schedule . . . . . . . . . . . . . . . . . . . . . .

deducted in this return. Attach schedule . . . . . . . . .

9 Total. Add line 7 and line 8 . . . . . . . . . . . . . .

6

Total.

10 Net income per return.

Add line 1 through line 5 . . . . . . . . . . . . . . . . . . . . .

Subtract line 9 from line 6 . . . . . . . . . . . . . .

Side 2 Form 199

2011

C1

3652113

1

1 2

2