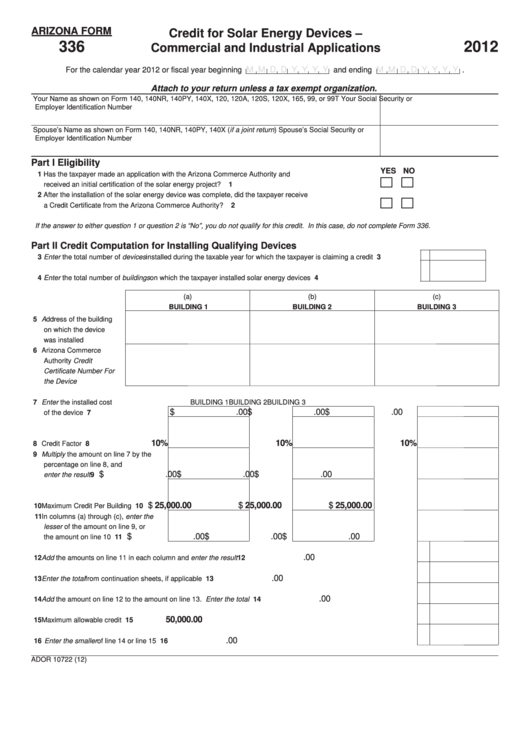

ARIZONA FORM

Credit for Solar Energy Devices –

336

2012

Commercial and Industrial Applications

M M D D Y Y Y Y

M M D D Y Y Y Y

For the calendar year 2012 or fiscal year beginning

and ending

.

Attach to your return unless a tax exempt organization.

Your Name as shown on Form 140, 140NR, 140PY, 140X, 120, 120A, 120S, 120X, 165, 99, or 99T

Your Social Security or

Employer Identification Number

Spouse’s Name as shown on Form 140, 140NR, 140PY, 140X (if a joint return)

Spouse’s Social Security or

Employer Identification Number

Part I

Eligibility

YES NO

1 Has the taxpayer made an application with the Arizona Commerce Authority and

received an initial certification of the solar energy project? ......................................................................

1

2 After the installation of the solar energy device was complete, did the taxpayer receive

a Credit Certificate from the Arizona Commerce Authority? .....................................................................

2

If the answer to either question 1 or question 2 is “No”, you do not qualify for this credit. In this case, do not complete Form 336.

Part II

Credit Computation for Installing Qualifying Devices

3 Enter the total number of devices installed during the taxable year for which the taxpayer is claiming a credit ...................

3

4 Enter the total number of buildings on which the taxpayer installed solar energy devices ...................................................

4

(a)

(b)

(c)

BUILDING 1

BUILDING 2

BUILDING 3

5 Address of the building

on which the device

was installed ................

6 Arizona Commerce

Authority Credit

Certificate Number For

the Device....................

7 Enter the installed cost

BUILDING 1

BUILDING 2

BUILDING 3

$

.00

$

.00

$

.00

of the device ..................................... 7

10%

10%

10%

8 Credit Factor ..................................... 8

9 Multiply the amount on line 7 by the

percentage on line 8, and

$

.00

$

.00

$

.00

enter the result.................................. 9

$

25,000.00

$

25,000.00

$

25,000.00

10 Maximum Credit Per Building ........... 10

11 In columns (a) through (c), enter the

lesser of the amount on line 9, or

$

.00

$

.00

$

.00

the amount on line 10 ....................... 11

.00

12 Add the amounts on line 11 in each column and enter the result .........................................................................................

12

.00

13 Enter the total from continuation sheets, if applicable ..........................................................................................................

13

.00

14 Add the amount on line 12 to the amount on line 13. Enter the total ..................................................................................

14

50,000.00

15 Maximum allowable credit ....................................................................................................................................................

15

.00

16 Enter the smaller of line 14 or line 15 ...................................................................................................................................

16

ADOR 10722 (12)

1

1 2

2 3

3