Instructions For Form Part-100 (Form Nj-1065) - 2011

ADVERTISEMENT

16

————————————————— 2011 Form NJ-1065 ————————————————

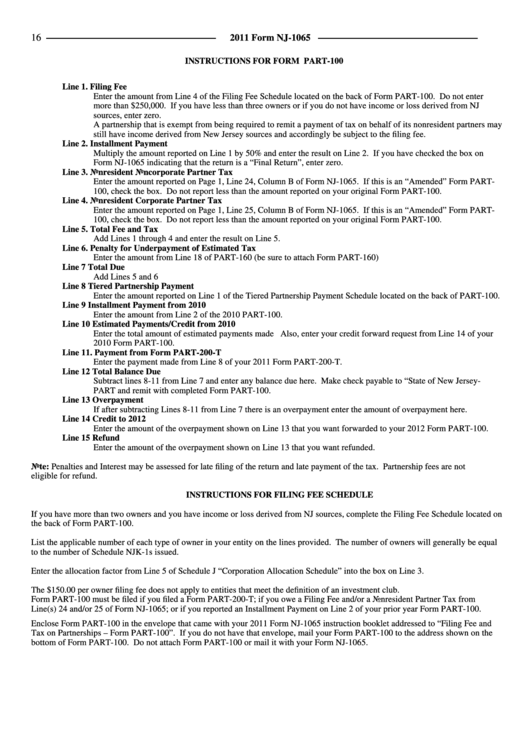

INSTRUCTIONS FOR FORM PART-100

Line 1. Filing Fee

Enter the amount from Line 4 of the Filing Fee Schedule located on the back of Form PART-100. Do not enter

more than $250,000. If you have less than three owners or if you do not have income or loss derived from NJ

sources, enter zero.

A partnership that is exempt from being required to remit a payment of tax on behalf of its nonresident partners may

still have income derived from New Jersey sources and accordingly be subject to the filing fee.

Line 2. Installment Payment

Multiply the amount reported on Line 1 by 50% and enter the result on Line 2. If you have checked the box on

Form NJ-1065 indicating that the return is a “Final Return”, enter zero.

Line 3. Nonresident Noncorporate Partner Tax

Enter the amount reported on Page 1, Line 24, Column B of Form NJ-1065. If this is an “Amended” Form PART-

100, check the box. Do not report less than the amount reported on your original Form PART-100.

Line 4. Nonresident Corporate Partner Tax

Enter the amount reported on Page 1, Line 25, Column B of Form NJ-1065. If this is an “Amended” Form PART-

100, check the box. Do not report less than the amount reported on your original Form PART-100.

Line 5. Total Fee and Tax

Add Lines 1 through 4 and enter the result on Line 5.

Line 6. Penalty for Underpayment of Estimated Tax

Enter the amount from Line 18 of PART-160 (be sure to attach Form PART-160)

Line 7 Total Due

Add Lines 5 and 6

Line 8 Tiered Partnership Payment

Enter the amount reported on Line 1 of the Tiered Partnership Payment Schedule located on the back of PART-100.

Line 9 Installment Payment from 2010

Enter the amount from Line 2 of the 2010 PART-100.

Line 10 Estimated Payments/Credit from 2010

Enter the total amount of estimated payments made Also, enter your credit forward request from Line 14 of your

2010 Form PART-100.

Line 11. Payment from Form PART-200-T

Enter the payment made from Line 8 of your 2011 Form PART-200-T.

Line 12 Total Balance Due

Subtract lines 8-11 from Line 7 and enter any balance due here. Make check payable to “State of New Jersey-

PART and remit with completed Form PART-100.

Line 13 Overpayment

If after subtracting Lines 8-11 from Line 7 there is an overpayment enter the amount of overpayment here.

Line 14 Credit to 2012

Enter the amount of the overpayment shown on Line 13 that you want forwarded to your 2012 Form PART-100.

Line 15 Refund

Enter the amount of the overpayment shown on Line 13 that you want refunded.

Note:

Penalties and Interest may be assessed for late filing of the return and late payment of the tax. Partnership fees are not

eligible for refund.

INSTRUCTIONS FOR FILING FEE SCHEDULE

If you have more than two owners and you have income or loss derived from NJ sources, complete the Filing Fee Schedule located on

the back of Form PART-100.

List the applicable number of each type of owner in your entity on the lines provided. The number of owners will generally be equal

to the number of Schedule NJK-1s issued.

Enter the allocation factor from Line 5 of Schedule J “Corporation Allocation Schedule” into the box on Line 3.

The $150.00 per owner filing fee does not apply to entities that meet the definition of an investment club.

Form PART-100 must be filed if you filed a Form PART-200-T; if you owe a Filing Fee and/or a Nonresident Partner Tax from

Line(s) 24 and/or 25 of Form NJ-1065; or if you reported an Installment Payment on Line 2 of your prior year Form PART-100.

Enclose Form PART-100 in the envelope that came with your 2011 Form NJ-1065 instruction booklet addressed to “Filing Fee and

Tax on Partnerships – Form PART-100”. If you do not have that envelope, mail your Form PART-100 to the address shown on the

bottom of Form PART-100. Do not attach Form PART-100 or mail it with your Form NJ-1065.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1