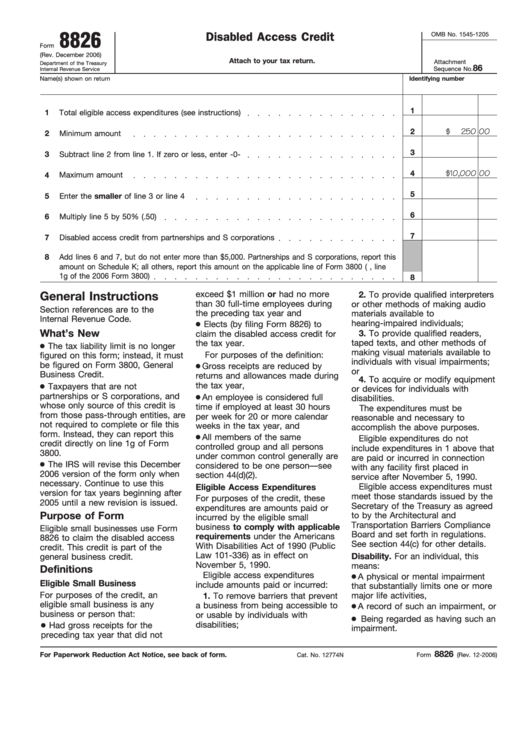

8826

OMB No. 1545-1205

Disabled Access Credit

Form

(Rev. December 2006)

Attach to your tax return.

Attachment

Department of the Treasury

86

Sequence No.

Internal Revenue Service

Name(s) shown on return

Identifying number

1

1

Total eligible access expenditures (see instructions)

2

$

250 00

2

Minimum amount

3

3

Subtract line 2 from line 1. If zero or less, enter -0-

4

$10,000 00

4

Maximum amount

5

5

Enter the smaller of line 3 or line 4

6

6

Multiply line 5 by 50% (.50)

7

7

Disabled access credit from partnerships and S corporations

8

Add lines 6 and 7, but do not enter more than $5,000. Partnerships and S corporations, report this

amount on Schedule K; all others, report this amount on the applicable line of Form 3800 (e.g., line

1g of the 2006 Form 3800)

8

exceed $1 million or had no more

2. To provide qualified interpreters

General Instructions

than 30 full-time employees during

or other methods of making audio

Section references are to the

the preceding tax year and

materials available to

Internal Revenue Code.

hearing-impaired individuals;

Elects (by filing Form 8826) to

What’s New

3. To provide qualified readers,

claim the disabled access credit for

the tax year.

taped texts, and other methods of

The tax liability limit is no longer

making visual materials available to

For purposes of the definition:

figured on this form; instead, it must

individuals with visual impairments;

be figured on Form 3800, General

Gross receipts are reduced by

or

Business Credit.

returns and allowances made during

4. To acquire or modify equipment

the tax year,

Taxpayers that are not

or devices for individuals with

partnerships or S corporations, and

An employee is considered full

disabilities.

whose only source of this credit is

time if employed at least 30 hours

The expenditures must be

from those pass-through entities, are

per week for 20 or more calendar

reasonable and necessary to

not required to complete or file this

weeks in the tax year, and

accomplish the above purposes.

form. Instead, they can report this

All members of the same

Eligible expenditures do not

credit directly on line 1g of Form

controlled group and all persons

include expenditures in 1 above that

3800.

under common control generally are

are paid or incurred in connection

The IRS will revise this December

considered to be one person—see

with any facility first placed in

2006 version of the form only when

section 44(d)(2).

service after November 5, 1990.

necessary. Continue to use this

Eligible Access Expenditures

Eligible access expenditures must

version for tax years beginning after

meet those standards issued by the

For purposes of the credit, these

2005 until a new revision is issued.

Secretary of the Treasury as agreed

expenditures are amounts paid or

Purpose of Form

to by the Architectural and

incurred by the eligible small

Transportation Barriers Compliance

business to comply with applicable

Eligible small businesses use Form

Board and set forth in regulations.

requirements under the Americans

8826 to claim the disabled access

See section 44(c) for other details.

With Disabilities Act of 1990 (Public

credit. This credit is part of the

Law 101-336) as in effect on

Disability. For an individual, this

general business credit.

November 5, 1990.

means:

Definitions

Eligible access expenditures

A physical or mental impairment

Eligible Small Business

include amounts paid or incurred:

that substantially limits one or more

For purposes of the credit, an

major life activities,

1. To remove barriers that prevent

eligible small business is any

a business from being accessible to

A record of such an impairment, or

business or person that:

or usable by individuals with

Being regarded as having such an

disabilities;

Had gross receipts for the

impairment.

preceding tax year that did not

8826

For Paperwork Reduction Act Notice, see back of form.

Cat. No. 12774N

Form

(Rev. 12-2006)

1

1 2

2