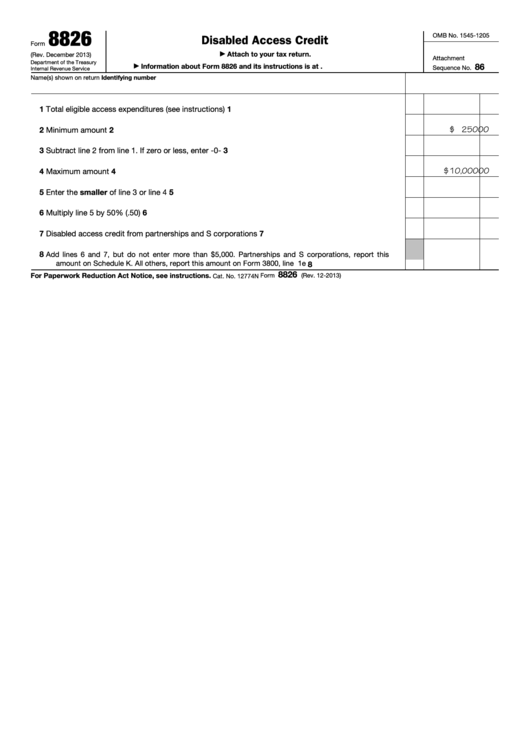

Form 8826 - Disabled Access Credit - Department Of The Treasury Internal Revenue Service

ADVERTISEMENT

8826

OMB No. 1545-1205

Disabled Access Credit

Form

Attach to your tax return.

(Rev. December 2013)

Attachment

Department of the Treasury

Information about Form 8826 and its instructions is at

86

Sequence No.

Internal Revenue Service

Name(s) shown on return

Identifying number

1

Total eligible access expenditures (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1

$ 250 00

2

Minimum amount .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

3

Subtract line 2 from line 1. If zero or less, enter -0- .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

$10,000 00

4

Maximum amount .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5

Enter the smaller of line 3 or line 4

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6

Multiply line 5 by 50% (.50) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7

Disabled access credit from partnerships and S corporations .

.

.

.

.

.

.

.

.

.

.

.

.

7

8

Add lines 6 and 7, but do not enter more than $5,000. Partnerships and S corporations, report this

amount on Schedule K. All others, report this amount on Form 3800, line 1e .

.

.

.

.

.

.

.

.

8

8826

For Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 12-2013)

Cat. No. 12774N

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1