Name:

TIN:

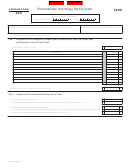

AZ Form 305 (2012)

Page 2 of 3

Part III S Corporation Credit Election and Shareholder’s Share of Credit and Credit Recapture

MM DD YYYY

MM DD YYYY

9 The S corporation has made an irrevocable election for the taxable year ending

to:

(CHECK ONLY ONE BOX)

Claim the environmental technology facility credit, as shown on Part I, line 3, column (b) (for the taxable year mentioned above);

OR

Pass the environmental technology facility credit, as shown on Part I, line 3, column (b) (for the taxable year mentioned above)

through to its shareholders.

Signature

Title

Date

If passing the credit through to the shareholders, complete lines 10 through 12 separately for each shareholder.

If passing credit recapture through to the shareholders, also complete line 13 separately for each shareholder.

Furnish each shareholder with a copy of pages 1, 2 and 3 of Form 305.

10 Name of shareholder

11 Shareholder’s TIN

00

12 Shareholder’s share of the current year’s credit from Part I, line 3, column (b) ............................................................... 12

00

13 Shareholder’s share of credit recapture from Part II, line 8 .............................................................................................. 13

Part IV Partner’s Share of Credit and Credit Recapture

Complete lines 14 through 16 separately for each partner.

If passing credit recapture through to the partners, also complete line 17 separately for each partner.

Furnish each partner with a copy of pages 1, 2 and 3 of Form 305.

14 Name of partner

15 Partner’s TIN

00

16 Partner’s share of the current year’s credit from Part I, line 3, column (b) ....................................................................... 16

00

17 Partner’s share of credit recapture from Part II, line 8 ...................................................................................................... 17

Part V

Credit Recapture Summary

18 Enter the taxable year(s) in which you took a credit or credit carryover for the facility that has ceased to operate as an

environmental manufacturing, producing or processing facility

00

19 Enter the total amount of credit originally claimed for the facility ...................................................................................... 19

20 Enter the total amount of the credit to be recaptured

• Individuals, corporations, and S corporations - enter the amount from Part II, line 8.

• S corporation shareholders - enter the amount from Part III, line 13.

00

• Partners of a partnership - enter the amount from Part IV, line 17 ........................................................................... 20

21 Subtract line 20 from line 19 and enter the difference. This is the amount of credit allowable for the

00

facility that has ceased to operate as an environmental manufacturing, producing or processing facility ....................... 21

00

22 Amount of credit on line 19 that you have claimed on prior years’ returns ....................................................................... 22

00

23 Subtract line 22 from line 21 and enter the difference ...................................................................................................... 23

If the difference is a positive number, that is the amount of credit carryover remaining that you may use in future taxable years. Enter this positive

number in Part VI, column (d), on the line for the year in which the disqualifi ed credit arose.

If the difference is a negative number, that is the amount of credit you must recapture. If a negative number, enter “zero” in Part VI, column (d),

on the line for the year in which the disqualifi ed credit arose.

• Corporations, also enter this amount as a positive number on Form 300, Part II, line 25.

• Individuals, also enter this amount as a positive number on Form 301, Part II, line 32.

ADOR 10132 (12)

1

1 2

2 3

3