Worksheet Vii - Calculation Of Interest On Underpayment Of Estimated Taxes - Short Method

ADVERTISEMENT

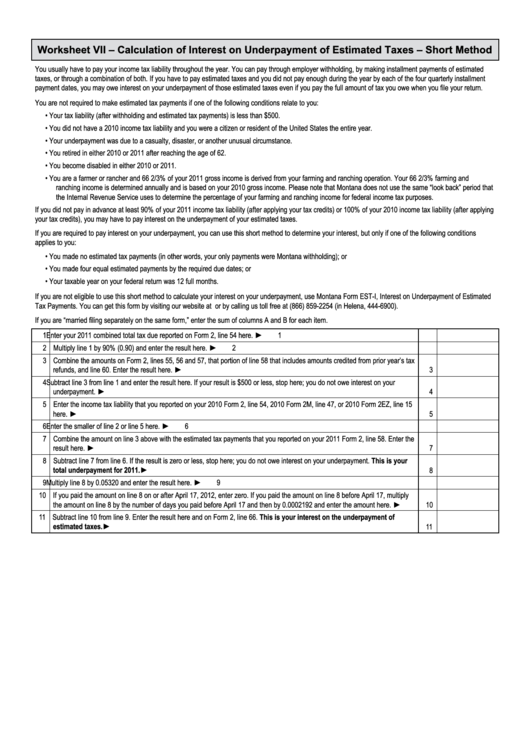

Worksheet VII – Calculation of Interest on Underpayment of Estimated Taxes – Short Method

You usually have to pay your income tax liability throughout the year. You can pay through employer withholding, by making installment payments of estimated

taxes, or through a combination of both. If you have to pay estimated taxes and you did not pay enough during the year by each of the four quarterly installment

payment dates, you may owe interest on your underpayment of those estimated taxes even if you pay the full amount of tax you owe when you file your return.

You are not required to make estimated tax payments if one of the following conditions relate to you:

• Your tax liability (after withholding and estimated tax payments) is less than $500.

• You did not have a 2010 income tax liability and you were a citizen or resident of the United States the entire year.

• Your underpayment was due to a casualty, disaster, or another unusual circumstance.

• You retired in either 2010 or 2011 after reaching the age of 62.

• You become disabled in either 2010 or 2011.

• You are a farmer or rancher and 66 2/3% of your 2011 gross income is derived from your farming and ranching operation. Your 66 2/3% farming and

ranching income is determined annually and is based on your 2010 gross income. Please note that Montana does not use the same “look back” period that

the Internal Revenue Service uses to determine the percentage of your farming and ranching income for federal income tax purposes.

If you did not pay in advance at least 90% of your 2011 income tax liability (after applying your tax credits) or 100% of your 2010 income tax liability (after applying

your tax credits), you may have to pay interest on the underpayment of your estimated taxes.

If you are required to pay interest on your underpayment, you can use this short method to determine your interest, but only if one of the following conditions

applies to you:

• You made no estimated tax payments (in other words, your only payments were Montana withholding); or

• You made four equal estimated payments by the required due dates; or

• Your taxable year on your federal return was 12 full months.

If you are not eligible to use this short method to calculate your interest on your underpayment, use Montana Form EST-I, Interest on Underpayment of Estimated

Tax Payments. You can get this form by visiting our website at revenue.mt.gov or by calling us toll free at (866) 859-2254 (in Helena, 444-6900).

If you are “married filing separately on the same form,” enter the sum of columns A and B for each item.

1 Enter your 2011 combined total tax due reported on Form 2, line 54 here.

1

►

2 Multiply line 1 by 90% (0.90) and enter the result here.

2

►

3 Combine the amounts on Form 2, lines 55, 56 and 57, that portion of line 58 that includes amounts credited from prior year’s tax

refunds, and line 60. Enter the result here.

3

►

4 Subtract line 3 from line 1 and enter the result here. If your result is $500 or less, stop here; you do not owe interest on your

underpayment.

4

►

5 Enter the income tax liability that you reported on your 2010 Form 2, line 54, 2010 Form 2M, line 47, or 2010 Form 2EZ, line 15

here.

5

►

6 Enter the smaller of line 2 or line 5 here.

6

►

7 Combine the amount on line 3 above with the estimated tax payments that you reported on your 2011 Form 2, line 58. Enter the

result here.

7

►

8 Subtract line 7 from line 6. If the result is zero or less, stop here; you do not owe interest on your underpayment. This is your

total underpayment for 2011.

8

►

9 Multiply line 8 by 0.05320 and enter the result here.

9

►

10 If you paid the amount on line 8 on or after April 17, 2012, enter zero. If you paid the amount on line 8 before April 17, multiply

the amount on line 8 by the number of days you paid before April 17 and then by 0.0002192 and enter the amount here.

10

►

11 Subtract line 10 from line 9. Enter the result here and on Form 2, line 66. This is your interest on the underpayment of

estimated taxes.

11

►

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1