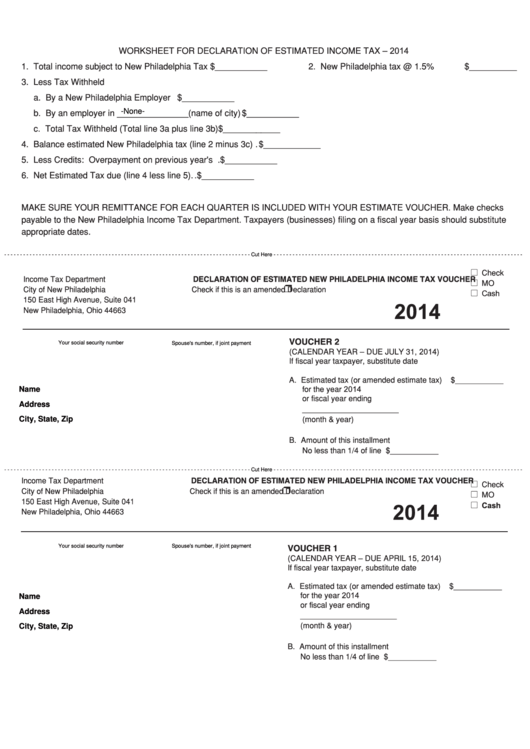

WORKSHEET FOR DECLARATION OF ESTIMATED INCOME TAX – 2014

1. Total income subject to New Philadelphia Tax $___________

2. New Philadelphia tax @ 1.5%

$__________

3. Less Tax Withheld

a. By a New Philadelphia Employer ............................................................$___________

-None-

b. By an employer in _______________(name of city) ...............................$___________

c. Total Tax Withheld (Total line 3a plus line 3b)...................................................................$____________

4. Balance estimated New Philadelphia tax (line 2 minus 3c).................................................... $____________

5. Less Credits: Overpayment on previous year's return.......................................................................................$___________

6. Net Estimated Tax due (line 4 less line 5). .........................................................................................................$___________

MAKE SURE YOUR REMITTANCE FOR EACH QUARTER IS INCLUDED WITH YOUR ESTIMATE VOUCHER. Make checks

payable to the New Philadelphia Income Tax Department. Taxpayers (businesses) filing on a fiscal year basis should substitute

appropriate dates.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - Cut Here - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Check

Income Tax Department

DECLARATION OF ESTIMATED NEW PHILADELPHIA INCOME TAX VOUCHER

MO

❒

City of New Philadelphia

Check if this is an amended Declaration

Cash

150 East High Avenue, Suite 041

2014

New Philadelphia, Ohio 44663

VOUCHER 2

Your social security number

Spouse's number, if joint payment

(CALENDAR YEAR – DUE JULY 31, 2014)

If fiscal year taxpayer, substitute date

A. Estimated tax (or amended estimate tax)

$___________

for the year 2014

Name

or fiscal year ending

Address

______________________

City, State, Zip

(month & year)

B. Amount of this installment

No less than 1/4 of line A........................... $___________

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - Cut Here - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Income Tax Department

DECLARATION OF ESTIMATED NEW PHILADELPHIA INCOME TAX VOUCHER

Check

❒

City of New Philadelphia

Check if this is an amended Declaration

MO

150 East High Avenue, Suite 041

2014

Cash

New Philadelphia, Ohio 44663

Your social security number

Spouse's number, if joint payment

VOUCHER 1

(CALENDAR YEAR – DUE APRIL 15, 2014)

If fiscal year taxpayer, substitute date

A. Estimated tax (or amended estimate tax)

$___________

for the year 2014

Name

or fiscal year ending

Address

______________________

(month & year)

City, State, Zip

B. Amount of this installment

No less than 1/4 of line A........................... $___________

1

1 2

2