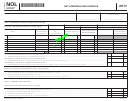

Schedule Nol (Form 41a720nol) - Net Operating Loss Schedule Page 2

ADVERTISEMENT

41A720NOL (10-13)

Page 2

Commonwealth of Kentucky

INSTRUCTIONS FOR SCHEDULE NOL (FORM 720)

DEPARTMENT OF REVENUE

Purpose of Schedule—Part I of this schedule is used by an

Line 3—Enter the totals for Column A and Column B. Reflect

affiliated group that is required to file a mandatory nexus

Column B as a positive amount.

consolidated return as provided by KRS 141.200(11) to

Line 4—This is the limitation provided by KRS 141.200(11)(b).

determine the net operating loss limitation as provided by KRS

141.200(11)(b) and to track any available net operating loss

Line 5—Enter the prior year NOL carryforward as a positive

carryforward. Part II of this schedule is used by a corporation

amount. A Schedule NOL-CF must be attached if the affiliated

filing a separate return as provided by KRS 141.200(10) to

group includes a member having an NOL carryforward that

track any available net operating loss carryforward.

was not a member of the affiliated group in the prior year.

Part I – Mandatory Nexus Consolidated Return

Line 6—This is the total NOL available.

General Instructions—Part I, Sections A and B of this

Line 7—This is the amount of the current year net operating

schedule are used by an affiliated group filing a mandatory

loss(es) that exceed(s) the 50 percent loss limitation. It is an

nexus consolidated return to determine the amount of net

add back in computing Kentucky net income and is entered

operating loss (NOL) deduction that can be utilized during

on Form 720, Part III, Line 19. If an amount is entered on Line

the current tax year and to track any available net operating

7, skip to Section B. Use worksheet below.

loss carryforward (NOL carryforward).

KRS 141.200(11)(b) provides that includible corporations

Worksheet—Line 7

that have incurred a net operating loss shall not deduct an

1. Amount from Line 3, Column B ..................$ __________________

amount that exceeds, in the aggregate, fifty percent (50%) of

2. Amount from Line 4, Column A ..................$ __________________

the income realized by the remaining includible corporations

that did not realize a net operating loss.

3. Line 1 less Line 2. Enter here and on

Part I, Section A, Line 7 (If less than

A current year NOL or an NOL carryforward as applied to a

zero, skip and complete Line 8) ..................$ __________________

mandatory nexus consolidated return is the pre-apportioned

net operating loss or pre-apportioned net operating loss

carryforward. Consequently, NOL carryforwards which are

Line 8—If the amount of loss limitation, Line 4, Column A is

apportioned may be converted to pre-apportioned amounts.

greater than the net operating loss(es) on Line 3, Column B,

However, a corporation that does not wish to convert the

a prior year NOL carryforward can be used to meet the 50

NOL carryforward to a pre-apportioned amount may carry

percent loss limitation. Enter the lesser of Line 4, Column

the NOL carryforward as an apportioned amount.

A less Line 3, Column B or the amount entered on Line 5,

Column C. If the amount of Line 4, Column A less Line 3,

If the corporation does not convert an apportioned NOL

Column B is equal to Line 5, Column C, enter the amount

carryforward to a pre-apportioned amount, the apportioned

from Line 5, Column C. Enter the amount on Form 720, Part

NOL carryforward is binding for all future years. Should

III, Line 19. This is a deduction in computing Kentucky net

the corporation wish to convert the apportioned NOL

income. Use worksheet below.

carryforward to a pre-apportioned NOL carryforward

in a future year, all tax returns filed which included the

Worksheet—Line 8

apportioned NOL carryforward must be amended. Also,

using an apportioned NOL carryforward does not affect the

1. Amount from Line 4, Column A ..................$ __________________

fifty percent (50%) limitation provided by KRS 141.200(11)

2. Amount from Line 3, Column B ..................$ __________________

(b) and, accordingly, the apportioned NOL carryforward is

3. Line 1 less Line 2. (If less than zero,

included in Part I, Section A of this schedule.

skip and complete Line 7 above) ................$ __________________

4. Amount from Line 5, Column C ..................$ __________________

A corporation does not have an NOL carryforward if it did

not have Kentucky nexus during the tax year of the NOL. An

5. Lesser of Line 3 or Line 4. Enter

here and on Part I, Section A,

NOL may be carried forward 20 years following the loss year;

Line 8 .............................................................$ __________________

however, as provided by KRS 141.011(2), an NOL shall not

be carried back for tax years beginning on or after January

1, 2005.

Section B – Current Year Loss Disallowed and NOL

Carryforward

Schedule NOL-CF is required if the affiliated group includes

a member having an NOL carryforward that was not a

General Instructions – Part I, Section B is used by an affiliated

member of the affiliated group in the prior year.

group filing a mandatory nexus consolidated return as

provided by KRS 141.200(11) to track any available net

Section A – Current Net Operating Loss Adjustment

operating loss carryforward. Follow the instructions on Lines

Enter the name, Kentucky Corporation/LLET account

1 through 4.

number and prior year’s NOL carryforward of the parent and

Part II – Separate Entity Return

subsidiaries.

NOL Carryforward

Column A—Enter only Kentucky net income of includible

corporations from Schedule KCR (Form 720), Line 18.

General Instructions – Part II is used by a corporation filing

Column B—Enter only Kentucky net losses of includible

a separate entity return as provided by KRS 141.200(10) to

track any available net operating loss carryforward. Follow

corporations from Schedule KCR (Form 720), Line 18. Enter

the instructions on Lines 1 through 4.

as a positive amount.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2