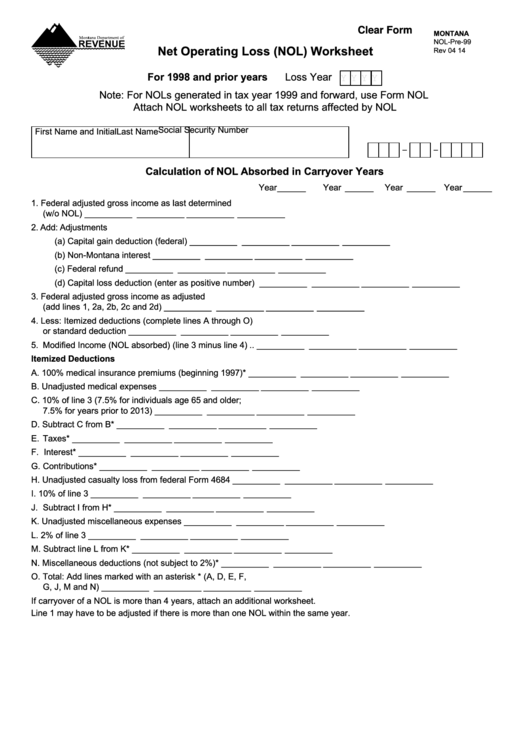

Clear Form

MONTANA

NOL-Pre-99

Net Operating Loss (NOL) Worksheet

Rev 04 14

For 1998 and prior years

Loss Year

Y Y Y Y

Note: For NOLs generated in tax year 1999 and forward, use Form NOL

Attach NOL worksheets to all tax returns affected by NOL

Social Security Number

First Name and Initial

Last Name

-

-

Calculation of NOL Absorbed in Carryover years

Year ______

Year ______

Year ______

Year ______

1. Federal adjusted gross income as last determined

(w/o NOL) ....................................................................... __________

__________

__________

__________

2. Add: Adjustments

(a) Capital gain deduction (federal) ........................... __________

__________

__________

__________

(b) Non-Montana interest ........................................... __________

__________

__________

__________

(c) Federal refund ...................................................... __________

__________

__________

__________

(d) Capital loss deduction (enter as positive number) __________

__________

__________

__________

3. Federal adjusted gross income as adjusted

(add lines 1, 2a, 2b, 2c and 2d) ...................................... __________

__________

__________

__________

4. Less: Itemized deductions (complete lines A through O)

or standard deduction ..................................................... __________

__________

__________

__________

5. Modified Income (NOL absorbed) (line 3 minus line 4) .. __________

__________

__________

__________

Itemized Deductions

A. 100% medical insurance premiums (beginning 1997) .... * __________

__________

__________

__________

B. Unadjusted medical expenses ........................................ __________

__________

__________

__________

C. 10% of line 3 (7.5% for individuals age 65 and older;

7.5% for years prior to 2013) .......................................... __________

__________

__________

__________

D. Subtract C from B ........................................................... * __________

__________

__________

__________

E. Taxes .............................................................................. * __________

__________

__________

__________

F. Interest ............................................................................ * __________

__________

__________

__________

G. Contributions .................................................................. * __________

__________

__________

__________

H. Unadjusted casualty loss from federal Form 4684 ......... __________

__________

__________

__________

I. 10% of line 3 ................................................................... __________

__________

__________

__________

J. Subtract I from H ............................................................ * __________

__________

__________

__________

K. Unadjusted miscellaneous expenses ............................. __________

__________

__________

__________

L. 2% of line 3 ..................................................................... __________

__________

__________

__________

M. Subtract line L from K ..................................................... * __________

__________

__________

__________

N. Miscellaneous deductions (not subject to 2%) ............... * __________

__________

__________

__________

O. Total: Add lines marked with an asterisk * (A, D, E, F,

G, J, M and N) ................................................................ __________

__________

__________

__________

If carryover of a NOL is more than 4 years, attach an additional worksheet.

Line 1 may have to be adjusted if there is more than one NOL within the same year.

1

1 2

2