Schedule Kcr (Form 720) - Kentucky Consolidated Return Schedule Page 2

ADVERTISEMENT

41A720KCR (10-13)

Page 2

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

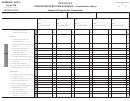

Schedule KCR—Kentucky Consolidated Return Schedule and

Schedule KCR–C—Kentucky Consolidated Return Schedule–Continuation Sheet

GENERAL INSTRUCTIONS

Purpose of Schedule—This schedule must be completed to compute the Kentucky consolidated net income of an affiliated group filing a mandatory nexus

consolidated Kentucky tax return as provided by KRS 141.200(11). Schedule KCR and, if applicable, Schedule(s) KCR-C must be attached to Form 720,

Kentucky Corporation Income Tax and LLET Return, filed with the Kentucky Department of Revenue.

Specific Instructions—For each subsidiary, enter the name, FEIN and Kentucky Corporation/LLET Account Number. If there are more than two subsidiaries

in the affiliated group, use Schedule KCR–C, Kentucky Consolidated Return Schedule—Continuation Sheet.

Line 1—Enter the amounts from Schedule CR and CR–C, Line 28 of each column in the respective columns of Schedule KCR and Schedule KCR–C.

Lines 2–10—Enter the additions to federal taxable income for the parent and each subsidiary using instructions for Form 720, Kentucky Corporation

Income Tax and LLET Return, Part III, Lines 2 through 10. Enter for each line the intercompany elimination in the Intercompany Eliminations column and

the consolidated total in the Consolidated Totals column.

Line 10—Enter Revenue Agent Report (RAR)(Form 4549) federal taxable income increase(s). Use this line only if amending Form 720 as a result of an RAR

adjustment (attach a copy of Form 4549 to the amended Form 720).

Line 11—Enter the total of Lines 1 through 10 in each column.

Lines 12–17—Enter the subtractions from federal taxable income for the parent and each subsidiary using instructions for Form 720, Kentucky Corporation

Income Tax and LLET Return, Part III, Lines 12 through 17. Enter for each line the intercompany elimination in the Intercompany Eliminations column and

the consolidated total in the Consolidated Totals column.

Line 17—Enter Revenue Agent Report (RAR)(Form 4549) federal taxable income decrease(s). Use this line only if amending Form 720 as a result of an RAR

adjustment (attach a copy of Form 4549 to the amended Form 720).

Line 18—Enter the amount of Line 11 less Lines 12 through 17 for each column.

Line 19—Enter net nonbusiness income from Schedule A, Section II, Line 3 in the total column and the applicable amounts in the columns for the parent

and each subsidiary.

Line 20—Enter Kentucky net nonbusiness income from Schedule A, Section II, Line 7 in the total column and the applicable amounts in the columns for

the parent and each subsidiary.

Enter the amounts from Line 1 through Line 18 of the Total column on Form 720, Part III, Lines 1 through 18.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2