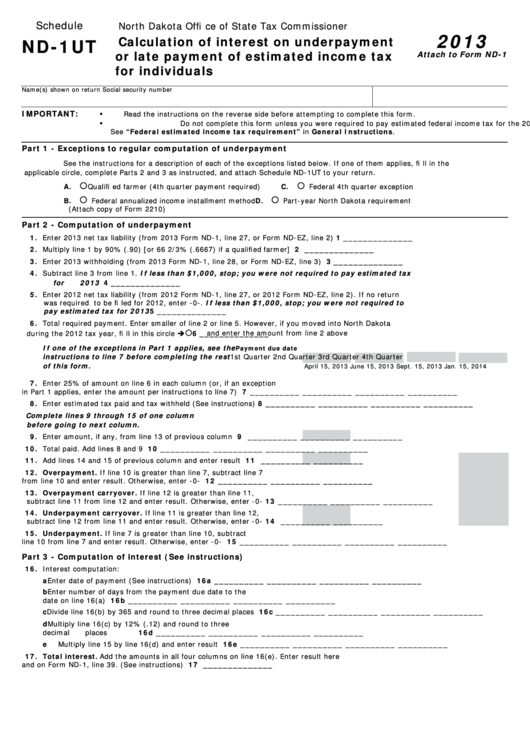

Schedule

North Dakota Offi ce of State Tax Commissioner

2013

Calculation of interest on underpayment

ND-1UT

or late payment of estimated income tax

Attach to Form ND-1

for individuals

Name(s) shown on return

Social security number

IMPORTANT:

Read the instructions on the reverse side before attempting to complete this form.

•

Do not complete this form unless you were required to pay estimated federal income tax for the 2013 tax year.

•

See “Federal estimated income tax requirement” in General Instructions.

Part 1 - Exceptions to regular computation of underpayment

See the instructions for a description of each of the exceptions listed below. If one of them applies, fi ll in the

applicable circle, complete Parts 2 and 3 as instructed, and attach Schedule ND-1UT to your return.

A.

Qualifi ed farmer (4th quarter payment required)

C.

Federal 4th quarter exception

B.

Federal annualized income installment method

D.

Part-year North Dakota requirement

(Attach copy of Form 2210)

Part 2 - Computation of underpayment

1. Enter 2013 net tax liability (from 2013 Form ND-1, line 27, or Form ND-EZ, line 2) ..................................... 1 ______________

2. Multiply line 1 by 90% (.90) [or 66 2/3% (.6667) if a qualifi ed farmer] ...................

2 ______________

3. Enter 2013 withholding (from 2013 Form ND-1, line 28, or Form ND-EZ, line 3) ......................................... 3 ______________

4. Subtract line 3 from line 1. If less than $1,000, stop; you were not required to pay estimated tax

for 2013 ......................................................................................................................................... 4 ______________

5. Enter 2012 net tax liability (from 2012 Form ND-1, line 27, or 2012 Form ND-EZ, line 2). If no return

was required to be fi led for 2012, enter -0-. If less than $1,000, stop; you were not required to

pay estimated tax for 2013 ............................................................................................................. 5 ______________

6. Total required payment. Enter smaller of line 2 or line 5. However, if you moved into North Dakota

and enter the amount from line 2 above

during the 2012 tax year, fi ll in this circle

............................. 6 ______________

If one of the exceptions in Part 1 applies, see the

Payment due date

instructions to line 7 before completing the rest

1st Quarter

2nd Quarter

3rd Quarter

4th Quarter

of this form.

April 15, 2013

June 15, 2013

Sept. 15, 2013

Jan. 15, 2014

7. Enter 25% of amount on line 6 in each column (or, if an exception

in Part 1 applies, enter the amount per instructions to line 7) .........

7 __________ __________ __________ __________

8. Enter estimated tax paid and tax withheld (See instructions)..........

8 __________ __________ __________ __________

Complete lines 9 through 15 of one column

before going to next column.

9. Enter amount, if any, from line 13 of previous column ...................

9

__________ __________ __________

10. Total paid. Add lines 8 and 9 ......................................................

10 __________ __________ __________ __________

11. Add lines 14 and 15 of previous column and enter result ...............

11

__________ __________

12. Overpayment. If line 10 is greater than line 7, subtract line 7

from line 10 and enter result. Otherwise, enter -0- .......................

12 __________ __________ __________

13. Overpayment carryover. If line 12 is greater than line 11,

subtract line 11 from line 12 and enter result. Otherwise, enter -0-

13 __________ __________ __________

14. Underpayment carryover. If line 11 is greater than line 12,

subtract line 12 from line 11 and enter result. Otherwise, enter -0-

14

__________ __________

15. Underpayment. If line 7 is greater than line 10, subtract

line 10 from line 7 and enter result. Otherwise, enter -0- ...............

15 __________ __________ __________ __________

Part 3 - Computation of interest (See instructions)

16. Interest computation:

a

Enter date of payment (See instructions) .............................. 16a __________ __________ __________ __________

b

Enter number of days from the payment due date to the

date on line 16(a) .............................................................. 16b __________ __________ __________ __________

c

Divide line 16(b) by 365 and round to three decimal places ..... 16c __________ __________ __________ __________

d

Multiply line 16(c) by 12% (.12) and round to three

decimal places ................................................................... 16d __________ __________ __________ __________

e

Multiply line 15 by line 16(d) and enter result ........................ 16e __________ __________ __________ __________

17. Total interest. Add the amounts in all four columns on line 16(e). Enter result here

and on Form ND-1, line 39. (See instructions) ...................................................................................... 17 ______________

1

1 2

2