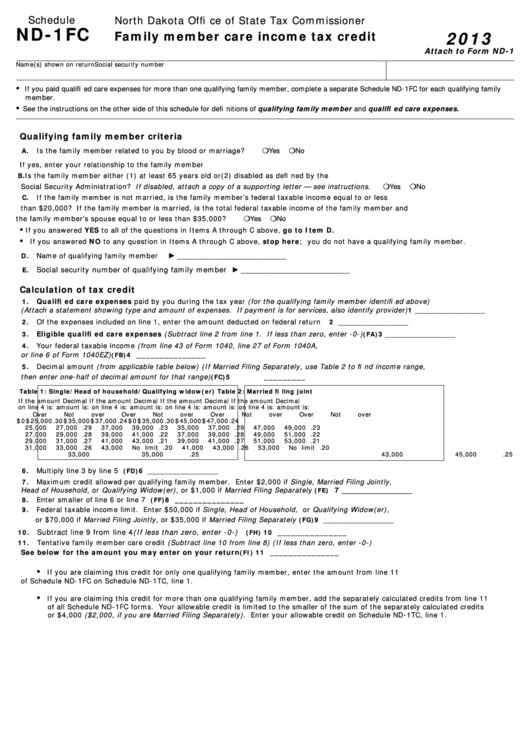

Schedule

North Dakota Offi ce of State Tax Commissioner

ND-1FC

2013

Family member care income tax credit

Attach to Form ND-1

Name(s) shown on return

Social security number

If you paid qualifi ed care expenses for more than one qualifying family member, complete a separate Schedule ND-1FC for each qualifying family

•

member.

See the instructions on the other side of this schedule for defi nitions of qualifying family member and qualifi ed care expenses.

•

Qualifying family member criteria

Is the family member related to you by blood or marriage? .........................................................................

Yes

No

A.

If yes, enter your relationship to the family member ..................................... __________________________

Is the family member either (1) at least 65 years old or (2) disabled as defi ned by the

B.

Social Security Administration? If disabled, attach a copy of a supporting letter — see instructions

.................

Yes

No

.

C.

If the family member is not married, is the family member’s federal taxable income equal to or less

than $20,000? If the family member is married, is the total federal taxable income of the family member and

the family member’s spouse equal to or less than $35,000? ........................................................................

Yes

No

If you answered YES to all of the questions in Items A through C above, go to Item D.

•

If you answered NO to any question in Items A through C above, stop here; you do not have a qualifying family member.

•

Name of qualifying family member ...........................................................................................

_________________________

D.

►

Social security number of qualifying family member

E.

...............................................................

►

_________________________

Calculation of tax credit

Qualifi ed care expenses paid by you during the tax year (for the qualifying family member identifi ed above)

1.

(Attach a statement showing type and amount of expenses. If payment is for services, also identify provider)

1 _________________

2.

Of the expenses included on line 1, enter the amount deducted on federal return .....................................

2 _________________

Eligible qualifi ed care expenses (Subtract line 2 from line 1. If less than zero, enter -0-) .....................

3.

(FA)

3 _________________

Your federal taxable income (from line 43 of Form 1040, line 27 of Form 1040A,

4.

or line 6 of Form 1040EZ) .....................................................................................

4 _______________

(FB)

Decimal amount (from applicable table below) (If Married Filing Separately, use Table 2 to fi nd income range,

5.

then enter one-half of decimal amount for that range) .........................................................................

5

_________

(FC)

Table 1: Single/Head of household/Qualifying widow(er)

Table 2: Married fi ling joint

If the amount

Decimal

If the amount

Decimal

If the amount

Decimal

If the amount

Decimal

on line 4 is:

amount is:

on line 4 is:

amount is:

on line 4 is:

amount is:

on line 4 is:

amount is:

Over

Not over

Over

Not over

Over

Not over

Over

Not over

$

0 $ 25,000

.30

$ 35,000 $ 37,000

.24

$

0 $ 35,000

.30

$ 45,000 $ 47,000

.24

25,000

27,000

.29

37,000

39,000

.23

35,000

37,000

.29

47,000

49,000

.23

27,000

29,000

.28

39,000

41,000

.22

37,000

39,000

.28

49,000

51,000

.22

29,000

31,000

.27

41,000

43,000

.21

39,000

41,000

.27

51,000

53,000

.21

31,000

33,000

.26

43,000

No limit

.20

41,000

43,000

.26

53,000

No limit

.20

33,000

35,000

.25

43,000

45,000

.25

Multiply line 3 by line 5 ....................................................................................................................

6.

(FD)

6 _________________

Maximum credit allowed per qualifying family member. Enter $2,000 if Single, Married Filing Jointly,

7.

Head of Household, or Qualifying Widow(er), or $1,000 if Married Filing Separately .................................

7 ________________

(FE)

Enter smaller of line 6 or line 7 .........................................................................................................

8.

8 _______________

(FF)

9.

Federal taxable income limit. Enter $50,000 if Single, Head of Household, or Qualifying Widow(er),

.................

or $70,000 if Married Filing Jointly, or $35,000 if Married Filing Separately

9 _________________

(FG)

Subtract line 9 from line 4 (If less than zero, enter -0-) ..............................................................

10.

10 _______________

(FH)

Tentative family member care credit (Subtract line 10 from line 8) (If less than zero, enter -0-)

11.

See below for the amount you may enter on your return ..............................................................

11 _______________

(FI)

If you are claiming this credit for only one qualifying family member, enter the amount from line 11

•

of Schedule ND-1FC on Schedule ND-1TC, line 1.

•

If you are claiming this credit for more than one qualifying family member, add the separately calculated credits from line 11

of all Schedule ND-1FC forms. Your allowable credit is limited to the smaller of the sum of the separately calculated credits

or $4,000 ($2,000, if you are Married Filing Separately). Enter your allowable credit on Schedule ND-1TC, line 1.

1

1 2

2