Form Cg-114-E - Expedited Claim For Refund For Indian Tax-Exempt Cigarette Sales

ADVERTISEMENT

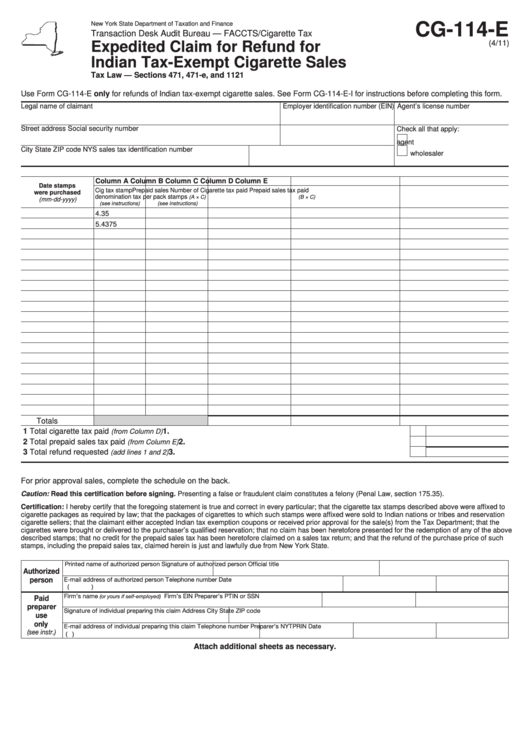

CG-114-E

New York State Department of Taxation and Finance

Transaction Desk Audit Bureau — FACCTS/Cigarette Tax

(4/11)

Expedited Claim for Refund for

Indian Tax-Exempt Cigarette Sales

Tax Law — Sections 471, 471-e, and 1121

Use Form CG-114-E only for refunds of Indian tax-exempt cigarette sales. See Form CG-114-E-I for instructions before completing this form.

Legal name of claimant

Employer identification number (EIN) Agent’s license number

Street address

Social security number

Check all that apply:

agent

City

State

ZIP code

NYS sales tax identification number

wholesaler

Column A

Column B

Column C

Column D

Column E

Date stamps

Cig tax stamp

Prepaid sales

Number of

Cigarette tax paid

Prepaid sales tax paid

were purchased

denomination

tax per pack

stamps

(A × C)

(B × C)

(mm-dd-yyyy)

(see instructions)

(see instructions)

4.35

5.4375

Totals

1 Total cigarette tax paid

..............................................................................................................

1.

(from Column D)

2 Total prepaid sales tax paid

......................................................................................................

2.

(from Column E)

3 Total refund requested

...........................................................................................................

3.

(add lines 1 and 2)

For prior approval sales, complete the schedule on the back.

Caution: Read this certification before signing. Presenting a false or fraudulent claim constitutes a felony (Penal Law, section 175.35).

Certification: I hereby certify that the foregoing statement is true and correct in every particular; that the cigarette tax stamps described above were affixed to

cigarette packages as required by law; that the packages of cigarettes to which such stamps were affixed were sold to Indian nations or tribes and reservation

cigarette sellers; that the claimant either accepted Indian tax exemption coupons or received prior approval for the sale(s) from the Tax Department; that the

cigarettes were brought or delivered to the purchaser’s qualified reservation; that no claim has been heretofore presented for the redemption of any of the above

described stamps; that no credit for the prepaid sales tax has been heretofore claimed on a sales tax return; and that the refund of the purchase price of such

stamps, including the prepaid sales tax, claimed herein is just and lawfully due from New York State.

Printed name of authorized person

Signature of authorized person

Official title

Authorized

person

E-mail address of authorized person

Telephone number

Date

(

)

Firm’s name

Firm’s EIN

Preparer’s PTIN or SSN

Paid

(or yours if self-employed)

preparer

Signature of individual preparing this claim

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this claim

Telephone number

Preparer’s NYTPRIN

Date

(see instr.)

(

)

Attach additional sheets as necessary.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2