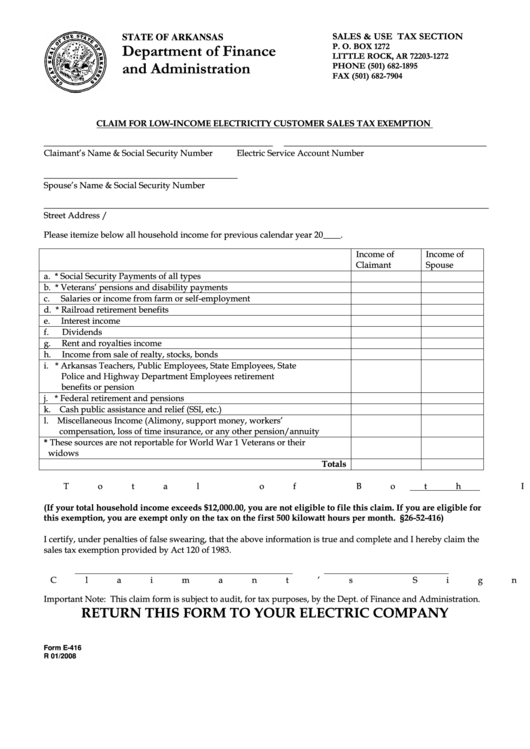

SALES & USE TAX SECTION

STATE OF ARKANSAS

P. O. BOX 1272

Department of Finance

LITTLE ROCK, AR 72203-1272

and Administration

PHONE (501) 682-1895

FAX (501) 682-7904

sales.tax@rev.state.ar.us

CLAIM FOR LOW-INCOME ELECTRICITY CUSTOMER SALES TAX EXEMPTION

____________________________________________________

______________________________________________

Claimant’s Name & Social Security Number

Electric Service Account Number

____________________________________________

Spouse’s Name & Social Security Number

_____________________________________________________________________________________________________

Street Address / P.O. Box

Apt. No. or Rural Address

City

State

Zip Code

Please itemize below all household income for previous calendar year 20____.

Income of

Income of

Claimant

Spouse

a. * Social Security Payments of all types

b. * Veterans’ pensions and disability payments

c.

Salaries or income from farm or self-employment

d. * Railroad retirement benefits

e.

Interest income

f.

Dividends

g.

Rent and royalties income

h.

Income from sale of realty, stocks, bonds

i. * Arkansas Teachers, Public Employees, State Employees, State

Police and Highway Department Employees retirement

benefits or pension

j. * Federal retirement and pensions

k. Cash public assistance and relief (SSI, etc.)

l. Miscellaneous Income (Alimony, support money, workers’

compensation, loss of time insurance, or any other pension/annuity

* These sources are not reportable for World War 1 Veterans or their

widows

Totals

Total of Both Incomes

(If your total household income exceeds $12,000.00, you are not eligible to file this claim. If you are eligible for

this exemption, you are exempt only on the tax on the first 500 kilowatt hours per month. A.C.A §26-52-416)

I certify, under penalties of false swearing, that the above information is true and complete and I hereby claim the

sales tax exemption provided by Act 120 of 1983.

Claimant’s Signature

Date

Important Note: This claim form is subject to audit, for tax purposes, by the Dept. of Finance and Administration.

RETURN THIS FORM TO YOUR ELECTRIC COMPANY

Form E-416

R 01/2008

1

1