Form CC Instructions

All organizations must annually complete

How to file

Note: If the total shortages exceed 0.3 percent, the discrep-

ancies should be investigated. The cash counted for each

and submit a separate Form CC for each

Part 1

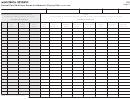

game should reconcile to Form LG861, Pull-tab, Game: Site

site to record the certified cash count by

Part 1 must be completed by two individuals of the orga-

Control-Tracking and Auditing.

nization who are not directly involved with the gambling

site.

activities or by an independent CPA.

Part 3

Part 3 may also be completed by a member of the organiza-

All cash must be counted and entered in column D. If there

A certified cash count must be taken for each site on the last

tion who is directly involved with the gambling operation.

are games in play, also complete columns A, B and C.

day of the fiscal year at the close of business, or the first day

of the new fiscal year before the start of business.

Once all games in play have been audited and the cash

Note: Electronic pull-tab games do not need to be audited.

counted, enter the totals into the Start bank reconciliation

Deposit all proceeds from the electronic pull-tabs prior to

The certified cash count must be completed by:

section.

cash count. Count the start bank and record on line 6 of the

• two members, officers or employees of the organiza-

Start Bank Reconciliation (part 3).

Note: Any available start bank for other forms of gambling

tion not directly involved in the organization’s gambling

(e.g., paddlewheel, raffle, bingo, electronic linked bingo and

activities who have been appointed by the organization’s

Part 2 (for pull-tab and/or tipboard games in

electronic pull-tabs banks) and/or back-up banks should be

board; or

play only)

included on line 6 for an accurate start bank total by site.

Part 2 may be completed by a member of the organization

• an independent certified public accountant (CPA).

who is involved with the gambling operation. However, the

Signatures

The individuals who conduct the cash count must sign the

individual(s) who conducts the cash count must observe the

form to certify that the information is correct.

The two individuals or CPA who conducted the cash count

game audit.

must sign the form certifying the information is correct.

Submit the completed Form CC to the chief executive of-

Audit each game in play. It is not necessary to close the

ficer (CEO) or gambling manager as soon as possible after

The individual who completes Parts 2 and 3 does not need

game after being audited.

the close of the organization’s fiscal year. The organization

to sign this form.

has 30 days from its fiscal year end to submit to the Depart-

ment of Revenue the necessary reporting forms, including

Questions?

Form CC for each site.

Website:

Email:

LawfulGambling.Taxes@state.mn.us

Phone: 651-297-1772

weekdays 8 a.m. to 4:30 p.m.

1

1 2

2 3

3