Form 4121 - Annual Gross Products Breakdown By County/tax District For Oil

ADVERTISEMENT

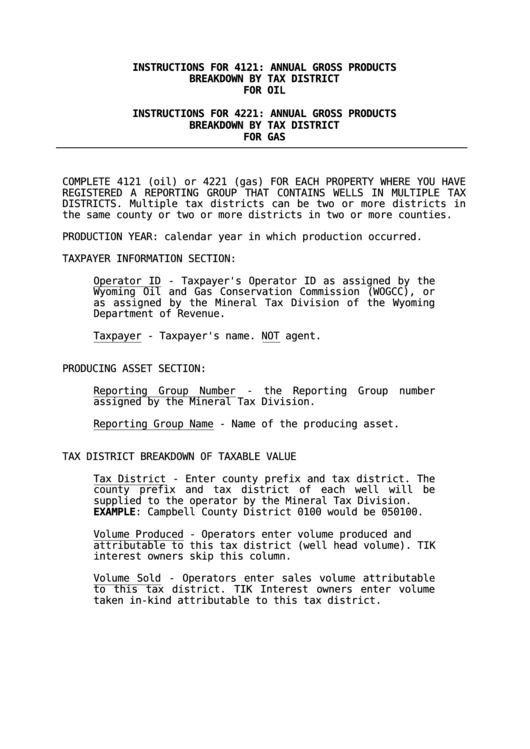

INSTRUCTIONS FOR 4121: ANNUAL GROSS PRODUCTS

BREAKDOWN BY TAX DISTRICT

FOR OIL

INSTRUCTIONS FOR 4221: ANNUAL GROSS PRODUCTS

BREAKDOWN BY TAX DISTRICT

FOR GAS

COMPLETE 4121 (oil) or 4221 (gas) FOR EACH PROPERTY WHERE YOU HAVE

REGISTERED A REPORTING GROUP THAT CONTAINS WELLS IN MULTIPLE TAX

DISTRICTS. Multiple tax districts can be two or more districts in

the same county or two or more districts in two or more counties.

PRODUCTION YEAR: calendar year in which production occurred.

TAXPAYER INFORMATION SECTION:

Operator ID - Taxpayer's Operator ID as assigned by the

Wyoming Oil and Gas Conservation Commission (WOGCC), or

as assigned by the Mineral Tax Division of the Wyoming

Department of Revenue.

Taxpayer - Taxpayer's name. NOT agent.

PRODUCING ASSET SECTION:

Reporting Group Number

-

the

Reporting

Group

number

assigned by the Mineral Tax Division.

Reporting Group Name - Name of the producing asset.

TAX DISTRICT BREAKDOWN OF TAXABLE VALUE

Tax District - Enter county prefix and tax district. The

county prefix and tax district of each well will be

supplied to the operator by the Mineral Tax Division.

EXAMPLE: Campbell County District 0100 would be 050100.

Volume Produced - Operators enter volume produced and

attributable to this tax district (well head volume). TIK

interest owners skip this column.

Volume Sold - Operators enter sales volume attributable

to this tax district. TIK Interest owners enter volume

taken in-kind attributable to this tax district.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5