R-5397 (7/06)

__________________________

Supplier/Permissive Supplier Return – Page 2

Revenue Account Number

All applicable schedules must be completed and attached.

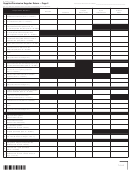

B

C

D

E

A

Undyed

Dyed

Aviation

Reportable Gallons

Gasohol

Gasoline

Diesel Fuels

Diesel Fuels

Fuels

All gallons sold/ removed at terminal rack for

15

unlicensed customers (Sch. C – R-5401)

All gallons removed at terminal rack

16

for LA licensees (Sch. C – R-5401)

Gallons imported/purchased outside the

17

bulk transfer/terminal system with LA

tax and inspection fee paid (Sch. A – R-5291)

Gallons imported/purchased outside

18

the bulk transfer/terminal system with

only inspection fee paid (Sch. A – R-5291)

Gallons imported/purchased outside the bulk

19

transfer/terminal system with no LA tax or

inspection fee paid (Sch. A – R-5291)

20

Gallons removed for own use (Sch. C – R-5401)

Diversions into LA with no LA tax

21

and/or fee paid (Sch. D – R-5402)

22

Other

23

Total (Add Lines 15 through 22.)

Nontaxable Removals Subject to Inspection Fee Only

Gallons removed and sold directly to U.S. gov-

24

ernment (See instructions) (Sch. C – R-5401)

Dyed diesel and dyed kerosene gallons

25

removed for non-highway purposes

(Sch. C – R-5401)

Aviation fuels removed/sold for aviation

26

purposes (Sch. C – R-5401)

27

Other

28

Total (Add Lines 24 through 27.)

Nontaxable Removals Not Subject to Inspection Fee

Gallons removed for export with destination

29

state tax collected (Sch. C – R-5401)

Diesel fuel removed for exempt

30

seagoing vessels (Sch. C – R-5401)

31

Diversions out of LA (Sch. D – R-5402)

32

Other

33

Total (Add Lines 29 through 32.)

Calculations of Taxable Gallons

Total reportable gallons

34

(Amount from Line 23)

Non-taxable Removals

35

(Total of Lines 28 and 33)

Net reportable gallons

36

(Subtract Line 35 from Line 34.)

37

Tax-paid purchases (Sch. A – R-5291)

Net gallons subject to tax (Subtract Line 37

38

from Line 36. Enter on Page 1, Line 1.)

Computation of Gallons Subject to Inspection Fee

Total gallons subject to inspection fee

39

(Subtract Line 33 from Line 23.)

Inspection fee – paid purchases

40

(Sch. A – R-5291)

Net gallons subject to inspection fee

41

(Subtract Line 40 from Line 39. Enter on

Page 1, Line 8.)

7642

1

1 2

2