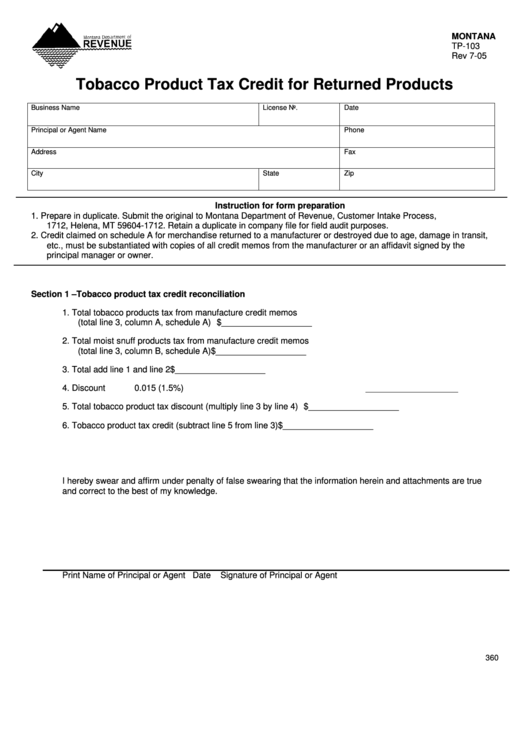

MONTANA

TP-103

Rev 7-05

Tobacco Product Tax Credit for Returned Products

Business Name

License No.

Date

Principal or Agent Name

Phone

Address

Fax

City

State

Zip

Instruction for form preparation

1. Prepare in duplicate. Submit the original to Montana Department of Revenue, Customer Intake Process, P.O. Box

1712, Helena, MT 59604-1712. Retain a duplicate in company file for field audit purposes.

2. Credit claimed on schedule A for merchandise returned to a manufacturer or destroyed due to age, damage in transit,

etc., must be substantiated with copies of all credit memos from the manufacturer or an affidavit signed by the

principal manager or owner.

Section 1 –Tobacco product tax credit reconciliation

1. Total tobacco products tax from manufacture credit memos

(total line 3, column A, schedule A) ............................................................ $ ___________________

2. Total moist snuff products tax from manufacture credit memos

(total line 3, column B, schedule A) ........................................................... $ ___________________

3. Total add line 1 and line 2 ........................................................................... $ ___________________

4. Discount rate................................................................................................

0.015 (1.5%)

5. Total tobacco product tax discount (multiply line 3 by line 4) ..................... $ ___________________

6. Tobacco product tax credit (subtract line 5 from line 3) .............................. $ ___________________

I hereby swear and affirm under penalty of false swearing that the information herein and attachments are true

and correct to the best of my knowledge.

Print Name of Principal or Agent

Date

Signature of Principal or Agent

360

1

1 2

2