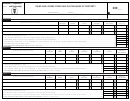

Corporation name

FEIN

Tax Year

FT 1120VL

Rev. 10/06

Page 2

Instructions

In accordance with Ohio Revised Code section (R.C.) 5733.04(I)(3) valuation

on which the tax provided for in R.C. 5733.06 is computed on the corporation’s

limitation is the loss or gain resulting from the sale, exchange or other disposi-

net income. For purposes of division (I)(3) of this section, the amount of the prior

tion of a capital asset or a section 1231 asset to the extent that such loss or gain

loss or gain shall be measured by the difference between the original cost or

occurred prior to the fi rst taxable year on which the franchise tax is computed on

other basis of the asset and the fair market value as of the beginning of the fi rst

the corporation’s net income.

taxable year on which the tax provided for in R.C. 5733.06 is computed on the

corporation’s net income. At the option of the taxpayer, the amount of the prior

The beginning of the fi rst taxable year on which the franchise tax is computed on

loss or gain may be a percentage of the gain or loss, which percentage shall be

the corporation’s net income is the beginning of the taxpayer’s fi rst franchise tax

determined by multiplying the gain or loss by a fraction, the numerator of which

accounting period which ended after Dec. 20, 1971 (the date of enactment of the

is the number of months from the acquisition of the asset to the beginning of the

net income basis of the franchise tax). See Clyde Williams Enterprises, Inc. and

fi rst taxable year on which the fee provided in R.C. 5733.06 is computed on the

Subsidiaries v Limbach, BTA Case No. 85-D-132, May 19, 1986.

corporation’s net income, and the denominator of which is the number of months

from the acquisition of the asset to the sale, exchange or other disposition of

Ohio Revised Code Section 5733.04(I)(3)

the asset. The adjustments described in this division do not apply to any gain

or loss where the gain or loss is recognized by a qualifying taxpayer, as defi ned

Add any loss or deduct any gain resulting from the sale, exchange or other dispo-

in R.C. 5733.0510, with respect to a qualifying taxable event, as defi ned in that

sition of a capital asset or an asset described in Internal Revenue Code section

section.

1231, to the extent that such loss or gain occurred prior to the fi rst taxable year

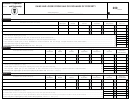

Gains and Losses from the Sale or Exchange of Property used in a Trade or Business (continued)

A

B

C

D

E

F

G

H

OR

*

Date Sold

Fraction

Gain

Valuation

*Allocable

Apportionable

Kind of Property

Date Acquired

(month,

or Loss

Limitation

(if necessary, attach description)

(month,

Gain or Loss

Gain or Loss

day, year)

day, year)

Column E less

Column E less

Column F

Column F

Total

1

1 2

2