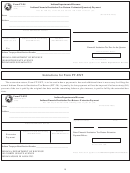

Credit Schedule

(If credits are being claimed by members of an affi liated group, a separate schedule is required for each entity that is claiming a credit.)

Entity entitled to credit: Name

FEIN

FIT account number

Nonrefundable Credits

Must attach credit certifi cate received from the Ohio Development Services Agency or Ohio Department of Commerce.

B

C

D

A

Credit Earned

Credits Claimed

Opening Unused

Closed Unused

During Current

During Current

Credit Balance

Credit Balance

Reporting Period

Reporting Period

1. Bank organization assessment

N/A

N/A

tax credit

2. New markets tax credit

3. Qualifi ed research expenses

credit

4. Qualifying dealers in intangibles

N/A

N/A

tax credit (2014 only)

5. Jobs retention tax credit

Refundable Credits

Must attach credit certifi cate received from the Ohio Development Services Agency.

1. Historic preservation tax credit – Schedule B, line 1 ................................................................................................ 1.

2. Jobs retention or jobs creation tax credit – Schedule B, line 2 ................................................................................. 2.

3. Tax credit for losses on loans made under the Ohio venture capital program – Schedule B, line 3 ......................... 3.

4. Ohio motion picture production tax credit – Schedule B, line 4 ................................................................................ 4.

5. Total of lines 1 through 4 .......................................................................................................................................... 5.

Declaration and Signature

(An offi cer or managing agent of the corporation must sign this declaration.)

I declare under penalties of perjury that this report (including any

use any of its money or property for or in aid of or opposition to

accompanying schedule or statement) has been examined by

a political party, a candidate for election or nomination to public

me and to the best of my knowledge and belief is a true, correct

offi ce, or a political action committee, legislation campaign fund,

and complete return and report, and that this corporation has not,

or organization that supports or opposes any such candidate or

during the preceding year, except as permitted by Ohio Revised

in any manner used any of its money for any partisan political

Code sections 3517.082, 3599.03 and 3599.031, directly or

purpose whatsoever, or for reimbursement or indemnifi cation of

indirectly paid, used or offered, consented, or agreed to pay or

any person for money or property so used.

Date (MM/DD/YY)

Signature of offi cer or managing agent

Title

Contact telephone no.

E-mail

1

1 2

2