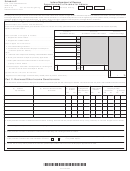

Form It-20s - Indiana S Corporation Income Tax Return - 2014 Page 23

ADVERTISEMENT

Instructions for Schedule IN K-1,

Part 2 - Distributive Share Amount

Complete lines 1 through 13 for the shareholder. Also provide

Shareholder’s/Partner’s Share of

the shareholder with a statement showing his distributive share of

Indiana Adjusted Gross Income,

income, credits, and modifications.

Deductions, Modifications, and Credits

Line 1 through Line 13b. For full-year Indiana resident

Enclose each shareholder’s IN K-1 with Form IT-20S. Also, provide a

shareholders, complete these lines as shown on the federal Schedule

completed copy of Schedule IN K-1 to each shareholder.

K-1, Form 1120S.

Note: Contact the department for alternative filing options for

For most nonresident shareholders, the federal Schedule K-1

Schedule IN K-1 at (317) 232-0129. For information on the

amounts should be multiplied by the Indiana apportionment

acceptable electronic data file format, visit the department’s website

percentage. This is calculated on the Schedule E (see the instructions

at

beginning on page 15). The apportioned amounts should be entered

on lines 1 through 13b. If any entries on lines 2 – 11 represent

Part 1 - Shareholder’s/Partner’s Identification

nonbusiness income to the S corporation, these amounts are

allocated to the appropriate state.

Section

Complete Schedule IN K-1 to identify each shareholder.

Line 4, “Guaranteed payments, ” is for those filing an IT-65. Leave this

(a) Enter the name of the shareholder, if an individual, and Social

line blank.

Security number.

(b) Enter other entity name if the shareholder is another entity or

Line 6, “Ordinary dividends, ” corresponds to line 5a on the federal

a fiduciary, and enter the federal identification number.

K-1. Line 9, “Net long-term capital gain (loss), ” corresponds to line

(c) Enter the shareholder’s state of residence or commercial

8a on the federal K-1.

domicile.

(d) Enter the FID of the payment entity and the amount of tax

On line 13a or 13b, include investment interest expenses attributed

withheld on income distributions derived from Indiana

to royalty income and all other federal deductions. (This excludes

sources for any nonresident shareholder for the taxable

those treated as itemized deductions.) Do not report any other type

year from either the IT-6WTH remittance or the WH-1

of investment interest expense, itemized deduction, or carryover loss

remittance. A WH-18, Indiana Miscellaneous Withholding

on this line.

Tax Statement for Nonresidents, must be prepared for

the nonresident shareholders that have opted out of the

Note: If the corporation has received any distributions from other

composite filing and whose withholding has been remitted

entities having income previously apportioned to Indiana, use the

into a nonresident withholding account by the S corporation.

following method to report distributive share income for Schedule

Do not include any penalty or interest paid on delinquent

IN K-1.

withholding tax. If no withholding tax was paid or if

additional withholding tax is due on opted-out shareholders,

Alternative Completion of Schedule IN K-1 Information for Part 2 –

use INtax to make payment. Credit for any amount withheld

You must use an alternative application of Schedule IN K-1 if:

must be claimed on the shareholder’s Indiana individual

•

A shareholder is a nonresident individual, fiduciary, or trust;

or fiduciary tax return. Enclose any WH-18s with amounts

and

withheld on behalf of this entity by another flow-through

•

The corporation had income from outside Indiana.

entity.

Example: Partnership A provides S corporation B a

Use the following method for completing Schedule IN K-1 when the

WH-18 indicating amounts of Indiana state tax withheld.

corporation had any apportioned income from outside Indiana or is

S corporation B does not claim the withholding credit

otherwise required to complete the Indiana apportionment schedule.

and passes the credit through to its shareholders. Proper

withholding credit is reflected by each S corporation B

Modify each required Schedule IN K-1 line entry by recalculating the

shareholder on the Indiana K-1. S corporation B must

pro rata share of total S corporation income with required Indiana

enclose copy A of the WH-18 with its Indiana IT-20S return.

modifications to adjusted gross income reported on line 1 of Form

If the S corporation has withholding liability in addition to

IT-20S. Use the pro rata amount from line 13A, Worksheet for

the pass-through withholding, S corporation B issues a

S Corporation Distributive Share Income, Deductions, and

WH-18 to each of its nonresident shareholders for this

Credits (worksheet), by applying these steps:

additional income only. This amount should be included on

Part 1 line (d), and copy A of the WH-18 should be enclosed.

Step 1. Deduct from the above pro rata share the respective pro rata

(e) Enter the applicable pro rata percentage of the shareholder’s

amount of line 13B and line 14B of the worksheet.

interest in the S corporation. The percentage should be

adjusted to an annual rate if necessary.

Step 2. Multiply the result by the Indiana apportionment percent

(f) Enter the shareholder’s tax as computed on Schedule

reported on line 4 of Form IT-20S, from Schedule E, line 8, if present.

IT-20SCOMP, column F.

This amount should reflect the shareholder’s proportionate share of

this S corporation’s activity in Indiana.

17

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32