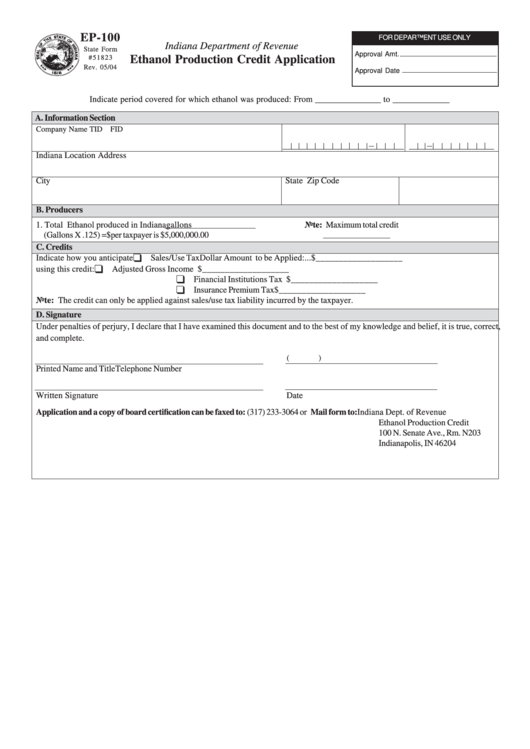

EP-100

FOR DEPARTMENT USE ONLY

Indiana Department of Revenue

State Form

Approval Amt.

#51823

Ethanol Production Credit Application

Rev. 05/04

Approval Date

Indicate period covered for which ethanol was produced: From _______________ to _____________

A. Information Section

Company Name

TID

FID

Indiana Location Address

City

State

Zip Code

B. Producers

1. Total Ethanol produced in Indiana

gallons

Note: Maximum total credit

a. Indiana Credit (Gallons X .125) = .................................................................... $

per taxpayer is $5,000,000.00

C. Credits

Indicate how you anticipate

Sales/Use Tax

Dollar Amount to be Applied: ... $___________________

using this credit:

Adjusted Gross Income Tax .................................................$___________________

Financial Institutions Tax ..................................................... $___________________

Insurance Premium Tax ......................................................... $___________________

Note: The credit can only be applied against sales/use tax liability incurred by the taxpayer.

D. Signature

Under penalties of perjury, I declare that I have examined this document and to the best of my knowledge and belief, it is true, correct,

and complete.

(

)

Printed Name and Title

Telephone Number

Written Signature

Date

Application and a copy of board certification can be faxed to: (317) 233-3064 or Mail form to:

Indiana Dept. of Revenue

Ethanol Production Credit

100 N. Senate Ave., Rm. N203

Indianapolis, IN 46204

1

1 2

2