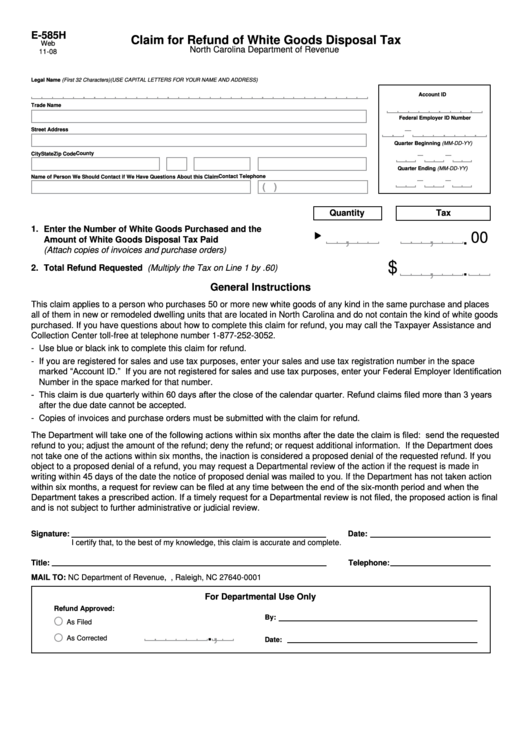

E-585H

Claim for Refund of White Goods Disposal Tax

Web

North Carolina Department of Revenue

11-08

Legal Name (First 32 Characters) (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Account ID

Trade Name

Federal Employer ID Number

Street Address

Quarter Beginning (MM-DD-YY)

County

City

State

Zip Code

Quarter Ending (MM-DD-YY)

Name of Person We Should Contact if We Have Questions About this Claim

Contact Telephone

(

)

Quantity

Tax

1.

Enter the Number of White Goods Purchased and the

,

,

.

00

Amount of White Goods Disposal Tax Paid

(Attach copies of invoices and purchase orders)

$

,

.

2.

Total Refund Requested (Multiply the Tax on Line 1 by .60)

General Instructions

This claim applies to a person who purchases 50 or more new white goods of any kind in the same purchase and places

all of them in new or remodeled dwelling units that are located in North Carolina and do not contain the kind of white goods

purchased. If you have questions about how to complete this claim for refund, you may call the Taxpayer Assistance and

Collection Center toll-free at telephone number 1-877-252-3052.

- Use blue or black ink to complete this claim for refund.

- If you are registered for sales and use tax purposes, enter your sales and use tax registration number in the space

marked “Account ID.” If you are not registered for sales and use tax purposes, enter your Federal Employer Identification

Number in the space marked for that number.

- This claim is due quarterly within 60 days after the close of the calendar quarter. Refund claims filed more than 3 years

after the due date cannot be accepted.

- Copies of invoices and purchase orders must be submitted with the claim for refund.

The Department will take one of the following actions within six months after the date the claim is filed: send the requested

refund to you; adjust the amount of the refund; deny the refund; or request additional information. If the Department does

not take one of the actions within six months, the inaction is considered a proposed denial of the requested refund. If you

object to a proposed denial of a refund, you may request a Departmental review of the action if the request is made in

writing within 45 days of the date the notice of proposed denial was mailed to you. If the Department has not taken action

within six months, a request for review can be filed at any time between the end of the six-month period and when the

Department takes a prescribed action. If a timely request for a Departmental review is not filed, the proposed action is final

and is not subject to further administrative or judicial review.

Signature:

Date:

I certify that, to the best of my knowledge, this claim is accurate and complete.

Title:

Telephone:

MAIL TO: NC Department of Revenue, P.O. Box 25000, Raleigh, NC 27640-0001

For Departmental Use Only

Refund Approved:

By:

As Filed

,

.

As Corrected

Date:

1

1